For the past 35 years, most power supplies have relied on power MOSFETs (metal oxide semiconductor field effect transistors) – voltage-controlled devices made of silicon that are used to switch and condition electricity.

These little black squares have done a great job, scaling their performance with Moore’s Law and making their way into all sorts of data center equipment, from PSUs to routers, switches and servers.

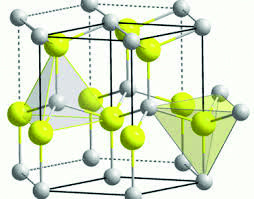

Killer crystal

But the entire power MOSFET family is about to become history, killed off by a class of devices that will be smaller, more efficient and cheaper too – at least in the long run. Enter gallium nitride (GaN), the wonderful semiconductor that is going to cut your electricity bills.

Thanks to a precedent set by Alexander Graham Bell, intermediate voltage comes into a data center at 48V and must go through multiple stages of power conversion before it reaches components on the board, losing a portion of its useful energy at every stage.

“Silicon wasn’t fast enough to get from 48V all the way to 1V,” Dr. Alex Lidow, chief executive of Efficient Power Conversion Corporation (EPC) and one of the inventors of the original power MOSFET told DCD.

“So what we [as an industry] did was create a whole bunch of very expensive power supplies that get you from 48V to 12V, and another set of power supplies that get you from 12V to 1V. And with gallium nitride, since it’s so damn fast, you can get rid of that whole intermediate bus and go directly from 48V to 1V.”

In 1999, Lidow became the chief executive of International Rectifier – the world’s oldest independent power semiconductor company, established by his father, Eric, and grandfather, Leon. In 2007, Lidow left to focus on his other venture, built on the belief that gallium nitride would change the world of electronics.

EPC has been manufacturing GaN chips since 2010 but the initial production costs were prohibitively high. Early applications included LIDAR lasers, wireless power transmitters and the ‘colonoscopy pill’ - the first ingestible imaging capsule that uses low-dose X-rays for cancer screening. As the costs went down, EPC turned its attention to data centers.

Significant market

“Now it’s becoming a significant market for us. It has taken many years to convince data center people that GaN is reliable enough – and to get our costs down to the point where it’s cost-effective for them to take the plunge,” Lidow said. “Maybe even more telling, Texas Instruments uses our product inside their products for data centers.”

48V power distribution throughout the rack is a hot topic, being investigated by major data center operators like Google, Facebook, AWS and Microsoft. Lidow told us most hyperscale companies are already testing GaN chips in their equipment - without naming any names.

According to EPC, transmission and power distribution losses mean that today, keeping a 580W machine switched on actually requires 860W of power to be produced. With GaN chips implemented every step of the way, we would need just 770W at the source.

It is not just power efficiency: GaN chips are also much smaller than their silicon counterparts, and produce less heat. Traditional power distribution components, together with the attendant heat sinks and fans, occupy valuable space on a server board that would be better spent accommodating additional CPU cores or RAM modules.

“It used to be that the server was like a mouth, ears and a brain – a lot came in through the ears, went out the mouth, but the brain didn’t have to do very much. Now with artificial intelligence and cloud computing the brain is really cranking, and there’s not that much more coming in through the ears or going out the mouth,” Lidow said.

“What this means is a server has to communicate internally a whole lot more, and that puts a different metric on performance: there’s a big push to condense the boards and pack the servers much tighter, so that you can get this thinking process going.

”That is limited by the heat and power density of these systems, so you need more efficient power conversion – that’s one of your largest sources of heat.”

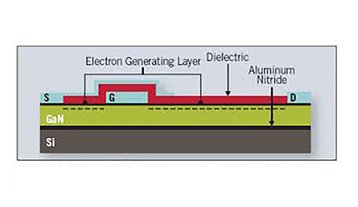

How they’re made

The manufacturing process for GaN chips involves growing a thin layer of gallium nitride on a standard piece of silicon, but the chips themselves are much smaller, therefore you get more chips for every manufacturing batch. During manufacturing, GaN is encapsulated in silicon, so it doesn’t require packaging - or additional protection.

“Moore’s Law kinda ran out of gas in power distribution before it ran out in digital,” Lidow said. “But with gallium nitride, our first chips were five to ten times better than the theoretical performance of silicon. We’ve been doubling that performance every few years, and we’re about to double it again.”

And there’s still room for growth: “Even with all that doubling in performance, we are still going to be around 300x away from theoretical performance of GaN.”

Next up for GaN chips, it’s the long slog up the supply chain. Texas Instruments uses EPC’s chips in products like the LMG5200 half bridge power stage, which are sold on to firms making power supplies, which are built into servers, storage and networking equipment. Hyperscalers could fast-track this, by adding components to their own hardware built to exact specifications.

Another company using gallium nitride for power distribution is GaN Systems, established in 2008 to capitalize on research carried out by now-defunct Nortel.

Slogging up the supply chain

“The entire industry recognizes that GaN is the future, it’s much better than silicon, it’s not an ‘if’, it’s a ‘when,’” Paul Wiener, VP for Strategic Marketing at GaN Systems told DCD.

Wiener thinks that ‘when’ can be brought much sooner if C-level executives at giant data center customers like Google, Facebook, Amazon and Microsoft shift their focus.

“The incremental purchase price is drowned out by the savings in opex and additional revenue,” he said. “Servers generate revenue - bits per dollar. The more data that those servers can process, and more servers can be put into a rack, the more revenue that rack generates.”

According to calculations published by GaN Systems, switching to gallium nitride can increase server space capacity by 14 percent. And that alone, without taking higher efficiency of chips into account, can boost the ‘incremental revenue potential per rack’ over three years by $31,686 - with one-time capital investment already subtracted.

Early adopters can buy equipment powered by GaN chips from a number of lesser known vendors: they will see considerable efficiency gains, but at a higher initial cost. GaN Systems expects its own chips will reach price parity with silicon-based power MOSFETs in 2019 or 2020 - making the latter all but obsolete.

This feature appeared in the power supplement published with the April/May 2017 issue of DCD Magazine