As they revealed their third quarter earnings reports, Amazon, Google-parent Alphabet and Microsoft all saw their share prices soar on the back of strong revenue growth across their myriad business sectors, with public cloud divisions gaining in importance.

While each company tracks cloud revenue differently, and the level of detail given varies, Amazon’s cloud operation remained comfortably in the lead.

King of the jungle

Amazon as a whole posted its tenth straight quarter of profit, with a net income of $256 million. Revenues hit $43.7 billion, including $1.3 billion from the recently acquired Whole Foods subsidiary, a 29 percent year-over-year jump.

Its cloud arm, Amazon Web Services, was the fastest-growing core business, with a 42 percent year-over-year increase in revenue, down from 55 percent in the last quarter. AWS now accounts for 11 percent of the company’s total revenue.

“Now we’re at an $18 billion run rate [quarterly revenue extrapolated over a whole year], whereas last quarter when I had this call, we were at $16 billion, so very pleased with the customer response in the AWS business as well,” Amazon’s CFO Brian Olsavsky said in an earnings call transcribed by Seeking Alpha.

“And usage growth is actually growing a lot higher than revenue growth. So particularly pleased with the new customers that we’ve added and the additional workloads that we’ve picked up from existing customers.”

The advertising company

Alphabet share price broke $1,000 as the company continued to dominate the advertising industry. It generated $27.77 billion in revenue, up 24 percent from a year ago, $7.8bn of which was profit.

As always, Google accounted for the vast majority of Alphabet’s revenue and income. But its Other Bets category, which includes Waymo driverless cars, Project Loon Internet balloons and IoT device maker Nest, saw revenues increase and losses fall - overall revenue hit $302m, up from $197m last year.

Google doesn’t identify Cloud Platform in its earnings results, lumping it together with Google Play and its hardware efforts. These combined divisions grew 40 percent year-over-year, hitting $3.4bn in revenues. Analysts at Canalys estimate that GCP brought in $870m in the quarter, up 76 percent year-over-year.

Google’s CEO, Sundar Pichai, said in an earnings call: “We continue to make progress winning over enterprise customers. Customers tell us they are switching to Google Cloud Platform because of our prowess in data analytics and machine learning, our commitment to being an open platform with tools like Kubernetes, which runs in both cloud and hybrid environments, and our leadership in security.

“Just yesterday we announced a new partnership at Cisco. We are collaborating on an open solution that gives customers an easy approach to the cloud, enabling them to run apps that span both on-prem environments and Google Cloud Platform. G Suite, our collaboration and productivity applications are leading the industry. We have made improvements to drive, docs and Gmail, launching new features to help teams work better together.”

Overall headcount at Google increased by 2,495 over the last quarter, with the company saying that most of its new hires went to fill technical and sales jobs in its cloud business.

As for its investments in data centers - vital for both Google Cloud business and its larger tech empire, CFO Ruth Porat explained that “accrued CapEx for the quarter was $3.6 billion, reflecting investments in production equipment, facilities and data center construction.”

Not just Windows

Microsoft reported $24.5 billion in revenue and profits of $6.6 billion, up from $20.4 billion and $4.7 billion the year before. $9.4 billion of that revenue came from Windows, Surface and Xbox, and $8.2 billion from Office, LinkedIn and Dynamics.

The company’s Intelligent Cloud division, meanwhile, grew 14 percent year-on-year to $6.9 billion. That includes Azure - Microsoft doesn’t disclose the individual revenue of the public cloud business, but the company did say Azure revenue jumped 90 percent year-on-year.

“We continue to invest in making Azure the most trusted cloud with AI-based security built in. Azure confidential computing enables encryption of in-use data to ensure that information is always under customer control, a first for any public cloud,” CEO Satya Nadella said in an earnings call.

“Our ongoing data center expansion brings Azure to 42 regions globally, more than any other cloud provider

“And new Azure availability zones provide new levels of resiliency for high-availability apps within a region and across regions.”

Comparing apples to bananas

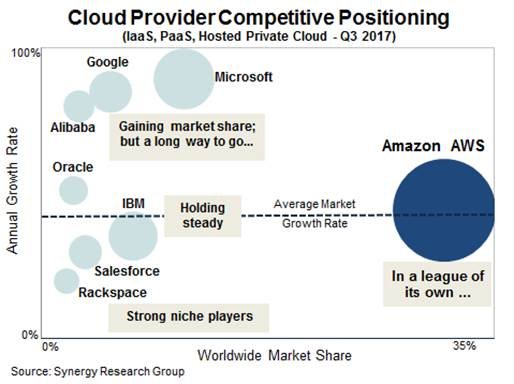

With some details withheld, and each company offering different types of cloud services, comparing the cloud giants is more of an art than a science, but enough was revealed to give some insight - namely that AWS is still king.

“While we forecast 40 percent growth in the total market for 2017, there’s still something a little shocking about seeing a business unit the size of AWS consistently growing its revenues by over 40 percent,” said John Dinsdale, chief analyst and research director at Synergy Research Group.

“Microsoft and Google too deserve plaudits for the growth rates they are achieving, while IBM is gaining market share in its sweet spot of hosted private cloud services. It is becoming increasingly difficult for cloud providers outside of the leading pack to make an impression on the market share rankings.”