China now accounts for 30% of data center white space in the Asia Pacific region (excluding Japan), according to the latest research from DatacenterDynamics Intelligence (DCDi).

The report, ‘Asia Pacific Key Trends’ received responses from 521 organizations across the region, which were then used to collect key data on data center growth, trends in space, power, investment and new technologies.

It found China has continued to show the highest rate of growth in terms of white space in the region at 24%, however, the rate of growth overall across the region has slowed in comparison to the previous year.

More than 70% of these respondents were working in a senior management position.

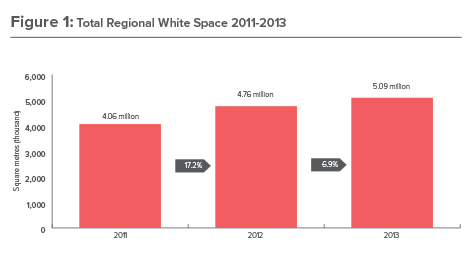

In total, Census respondents for APAC represented 5,090,000 sq m of white space - a figure which in itself grew by 7% in 2013.

Nick Parfitt, lead analyst for DCDi for the Asia Pacific region, said this slow growth has brought the region into line with other mature data center markets.

China and India are still seeing double digit growth however, albeit at a slower level than in the previous year.

Indonesia and Malaysia also saw double-digit growth in the number of racks accounted for.

Regional maturity

The regional data center landscape is “varied” in terms of market maturity, with Australia and New Zealand showing signs of decreasing spend on new builds. This is consistent with the mature markets of the UK and the US.

Australia and New Zealand account for the highest percentage of investment, spent on consolidation projects in the region. Conversely China, in line with the overall increase in white space across the country, continues to see the highest percentage of investment in new build.

In 2013, about US$4.9bn was invested into outsourcing services across the region - a 14% increase in figures seen for 2012.

"In 2014, investment in outsourcing is predicted to grow by 12% to US$5.5bn," Parfitt said.

Most of this investment is likley to come from Indian data center operators and owners followed by mainland China and Australia.

Investment in inhouse data center solutions rose by US$13.1bn in 2012 to $14.3bn in 2013 and investment is likley to further the market in 2014, with an estimated 8.6% rise in the year ahead.

Much of the region, however, is still dominated by local companies but global companies entering the market are representing the strongest growth for the market, which is likely to see further growth in third party-services such as cloud over the coming year.

Power

The increase in power requirements across the Asia Pacific region has significantly slowed over the past 12 months, illustrating the effectiveness of increased energy efficiency measures.

More than 70% of APAC resondents said they currently monitor thier energy consumption continuously.

China now accounts for 28% of all data center power in the region, though the highest rate of growth in power requirements was seen in Malaysia and Indonesia.

The total amount of power consumed by the APAC market is 6,075MW, as of mid 2013.

Colocation companies consumed 50% of the total power used by the APAC market.

Over the next two years, the authors of the report said they expected data center power demand in the region to grow by 12% year on year.

China leads Asia Pacific data center growth

China now accounts for 30% of data center white space in the Asia Pacific region (excluding Japan),