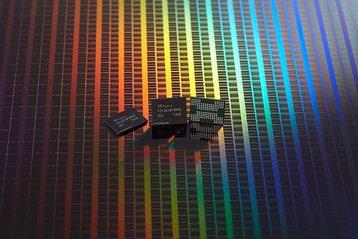

Chinese regulators have approved SK Hynix's acquisition of Intel's NAND business.

The $9 billion sale was agreed in October 2020, and after one year has been approved by all eight necessary countries. SK Hynix will pay $7bn by the end of this year and another $2bn in March 2025 to close the full takeover of the assets.

South Korean SK Hynix will be able to take over the US company's NAND memory chip business if it agrees to certain conditions, China's State Administration for Market Regulation said.

Among them is the promise that SK Hynix should not supply PCIe and SATA enterprise-class solid state drive products to China's domestic market at unreasonable prices.

The company will also have to expand its output of PCIe and SATA enterprise-class solid state drive products within five years of the merger's completion. The company cannot force customers in China's market to exclusively purchase products from SK Hynix or companies controlled by it.

"SK Hynix sincerely welcomes and appreciates the State Administration for Market Regulation's merger clearance for the deal," the company said in a statement.

"SK Hynix will enhance its competitiveness of NAND Flash and SSD business by continuing the remaining post-merger integration process."

The deal is the largest acquisition in SK Hynix's history.

Park Sung-soon, an analyst at Cape Investment & Securities, told Reuters: "This acquisition would likely help SK Hynix better expand its NAND solid state drive (SSD) business for enterprise customers like data centers as its NAND SSD business has been predominantly focused on consumer products such as smartphones and PCs."

Intel will retain its Intel Optane business; a technology system designed to improve storage speeds. Intel will also continue to manufacture NAND wafers at the Dalian facility and retain all IP related to its NAND flash wafers until 2025.