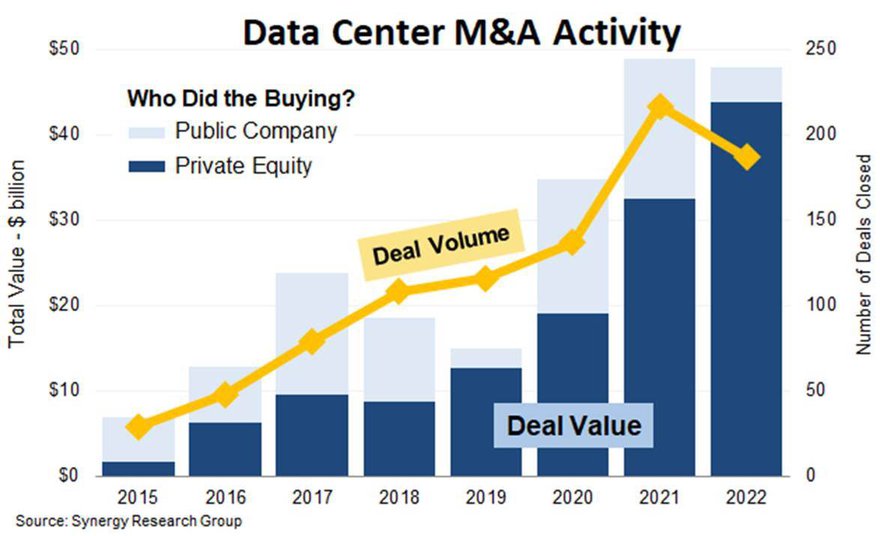

In a huge year of data center mergers and acquisitions, private equity led the vast majority of deals.

Overall, the 187 data center-oriented M&A deals that closed in 2022 that were tracked by Synergy Research totaled $48 billion - slightly behind the 2021 record of $49bn.

In 2020 private equity accounted for 55 percent of the value of closed deals, growing to 66 percent in 2021 and jumped to 91 percent last year.

Since 2018 private equity funding has risen by around 50 percent every year, reaching $44bn in 2022.

Overall, deals have grown over the past four years, with the average deal size almost tripling since 2018 - growing from $80 million to $235m.

The $15bn acquisition of CyrusOne by investment firms KKR and Global Investment Partners led 2022, followed by the acquisition of Switch by DigitalBridge for $11bn. The two deals were the largest in data center M&A history.

Private equity led ten of the twelve largest deals of 2022, with the exceptions being Equinix's acquisition of Entel’s data centers and Digital Realty’s acquisition of a majority stake in Teraco.

With so many companies going private, only six of the twenty largest colocation players in the US are now publicly traded companies.