It is clear 5G - whatever the marketing definition calls it this week - is going to drive significant changes and growth for data centers. But it is the Edge which is going to cause the most headaches, especially for service providers deploying 5G.

More bandwidth leads to more applications and more data, but the 5G twist of single digit latency at the Edge means back-end networks and core servers will have to speed up in order to keep up. For instance, there’s no sense in running an AR/VR application using 5G without the horsepower to support hundreds and thousands of distributed users.

Finding the use case

The IoT side of 5G will require more storage, but this growth should be gradual over time. If you have a thousand or ten thousand “things,” such things need to be built, shipped, installed and tested, with turnup happening in a relatively serial basis on the enterprise side of the world. If you are a big autonomous vehicle advocate and embrace Intel’s 'four terabytes per 90 minutes of driving generated' estimate, 5G will have something to do with moving that data, but Tesla and others seems to be doing fine without it for the time being.

Where data center life gets especially interesting is the current insistence Edge computing is necessary to service 5G applications, be they IoT or AR or yet-to-be-discovered concepts. Edge computing flies in the face of about a decade or more of NFV/SDN doctrine for data centers and carriers, with telecom providers particularly affected by this doctrinal shift. The holistic idea behind NFV and SDN was to leverage the centralization of the data center and virtualization of functions to get rid of dedicated hardware at the customer premise.

Functions would be virtualized and run within the perimeter of the data center, saving the expense and truck roll to distribute equipment, while allowing scalability based upon demand. Need more SBC or call center, simply fire up some more server processes.

The belief within the telecom community was the migration from analog to IP for voice call handling would free up power, physical space, and inventory overhead, enabling the consolidation and flattening of network resources in an all-IP environment due to NFV/SDN.

Fewer workers, fewer central offices (COs) to handle, with money saved in less electricity and money made by selling off real estate accumulated over the years. On the wireless side, a couple of decades of rapid leapfrog growth from 2G to 4G meant a move from a hodgepodge of cell tower hardware could now be replaced with a simple IP-based setup.

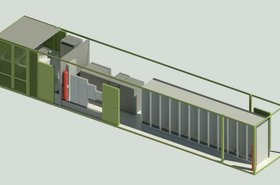

Edge computing comes along and kinks up the flattened model of a data center-centric world for service providers. The capital expense of real estate, racks, servers, cooling and power distribution along with the operational expenses of power, maintenance, and service contracts all go upward, not downward. Additional complexity comes into play by multi-variable calculations on where and how much compute power to plug into the Edge in order to deliver the maximum amount of high-quality/low-latency computing power to the highest paying customers.

On the fiber side of the world without getting into 5G religion, CenturyLink is a big and long-time believer in Edge computing. In its latest earnings call, as documented by SeekingAlpha, CEO Jeff Storey said the company is currently testing Edge with an “actual customer” and are able to process apps and data more efficiently by using Edge at 100 of CenturyLink’s locations as an aggregation, rather than on-premise processing at 2,000 separate customer locations or via backhaul to a central location.

Storey said Edge could be an important solution for retail, banking and other industries with a number of dispersed service locations that need to process large amount of data in real time. Edge isn’t going to kill the data center per se, but customers are going to run hybrid solutions combining traditional data center and applying Edge for performance-based needs.

AT&T, Verizon, Microsoft, and IBM, just to drop a few names, are all working the Edge computing space, believing the blend of Edge with 5G will be a better play than a stock data center hosting offering. CenturyLink’s leading/bleeding edge work is no doubt being processed by numerous large enterprises while Intel and other manufacturers can’t wait to see what profits they can gain from Edge adaption.

But let’s not pretend Edge computing isn’t going to be complicated. Picking the proper applications and deploying the appropriate resources at the necessary locations is a far cry from the hardware simplicity NFV and SDN promised the data center and telecom communities a few years ago. We’re talking more power, more real estate, more pre-sales engineers, probably more specialized and optimized hardware that is more custom and less commercial off-the-shelf just as a start.