A company’s environmental, social, and governance (ESG) risks and opportunities evaluation can be a major factor that drives investment decisions. PwC conducted research last fall that found 80 percent of investors named ESG as an important element in their investment decisions, 70 percent believed executive compensation should be tied to ESG targets, and half would be willing to divest from companies that weren’t sufficiently committed to ESG objectives.

Another key finding from the research: investors don’t always trust the quality of the information they receive to evaluate ESG initiatives. They aren’t alone in that. As The New York Times reported in June, investments in ESG funds rose by 38 percent over the past year, but Tesla founder Elon Musk called the industry a “scam” after S&P Global removed the carmaker from an ESG index. S&P Global countered that the removal was due in part to accusations of discrimination and worker mistreatment at Tesla.

As it stands now, ESG scoring is subjective, which exposes the effort to accusations of bias for or against a particular company. Additionally, it’s difficult to get reliable information about companies that operate in areas where the regulatory regime isn’t well developed, so apples-to-apples comparisons aren’t possible. Addressing these issues requires more than just universal standards. It also means agreeing on what data is needed and defining effective procedures for accessing and processing it.

The scale of the data challenge

There’s a broad consensus that ESG reporting needs to be standardized. As S&P Global CEO and President Doug Peterson told CNBC in March, the number of players in the space have made settling on an approach difficult with an “alphabet soup” of organizations trying to standardize ESG disclosures. Now, the International Sustainability Standards Board (ISSB) is leading an effort to bring various groups together to create a single approach for environmental impact reporting.

It will require time and effort to set reporting standards that are grounded in facts relevant to industries and regions, and while it’s not a trivial matter, it’s not an insurmountable challenge either. For companies that compile ESG reports, getting the data part of the equation right may prove to be a much more complicated issue. That’s a challenge companies that report environmental impact data will face no matter what standard is applied.

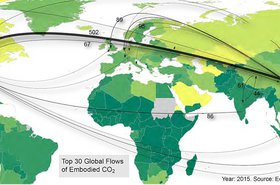

The complexity arises in part because there is a near-infinite number of sources of external data available. Organizations must not only engage in discovery to choose the correct sources for their purpose, but they must devote time and resources to data wrangling and the myriad of other tasks needed to ensure quality and move data into a production environment. Companies that get it wrong at any stage will undermine the entire effort, rendering their score meaningless. Additionally, training and education that enable data competency varies considerably across organizations, so getting it right isn’t a given.

Before identifying potential new data sources or vendors to answer the mounting issue of ESG, companies should first address the exact ESG-related issue they are trying to solve. Focus on closing any gaps within current datasets while identifying the exact areas or information that need improvement. Is current data providing outdated information or inaccurate reporting on carbon emissions, employee safety, and other ESG-related factors? Are there certain KPIs that aren’t being tracked? This will also provide data analysts and CTOs with information on where there’s room for interpretation--both good and bad--and how to effectively address any concerns that could arise from investors, government bodies, and even consumers.

Companies need an end-to-end workflow to ingest, process, and apply data correctly. That’s true of ESG and other data-intensive reporting that involves choosing external data sources, ingesting and processing large datasets, and blending it with internal information. This requires extensive data engineering expertise and tools. Organizations that don’t have the right personnel and resources in place may mishandle data in a way that erases their credibility.

What it will take to achieve ESG objectives

Creating more meaningful ESG reporting is a critical goal. It’s important to get it right, and because of the scale of data involved with environmental metrics especially, it won’t be easy. ESG is a relatively new discipline, so organizations are still contemplating their approach. To solve the standards and data challenges involved in ESG, everything has to come together in the right sequence.

Regulatory intensity within regions and industries contributes to the framework currently used for ESG reporting, and governing bodies are making efforts to create consensus on standards. As the regulatory regime evolves, industries will agree on standards and identify gaps, and then governing bodies will define new regulations to address the gaps.

But in every scenario, significantly reducing negative environmental impact will require a consistent flow of clean, real-time data so that investors and other interested parties are able and willing to put more trust into the facts on their screens. Everyone should keep in mind that much more than investment returns are at stake.