Amazon's 2021 sustainability report is a depressing read. Sure, the company has a massive list of interesting green initiatives. It buys a huge amount of renewable energy, and an order for 100,000 electric vehicles from one company (Rivian) is a big deal.

It also makes much of the Climate Pledge, its 2019 promise to beat the 2050 target of the Paris Climate Accords by 10 years, and "reach net-zero carbon emissions across our operations by 2040."

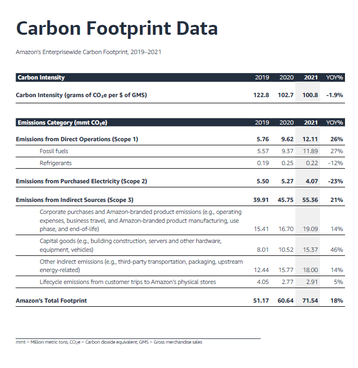

But by the end of the report, you wonder if that goal is getting any closer. however. On Amazon's own numbers it admits that its emissions are still going up. They've gone up by nearly 20 percent in both the last two years.

What's worse, it seems Amazon's numbers gloss over at least one gaping hole that blows apart its claims to be making progress to net zero.

Ignoring the facts

Amazon says its emissions problems are a result of its success. It's grown, and had to add more infrastructure. Amazon is a huge cloud services company, and a colossal retail operation. To run that, it needs computers in buildings, distribution warehouses, a network of delivery vehicles, and staff.

The company characterizes this growth as a success for the planet, with new jobs, and more packages delivered to "meet the needs of our customers through the pandemic." A 37 percent growth in AWS is also a benefit to companies moving to the cloud, where they are "gaining significant speed, innovation, and cost advantages."

The electricity Amazon uses is only one part of its environmental footprint. The footprint of its electricity is called "Scope 2" emissions, while Scope 1 emissions are the emissions created directly within the company, and Scope 3 is the emissions from its entire supply chain, upstream and downstream.

Amazon's growth means its Scope 1 emissions increased as it built and hired more resources. This growth more than canceled out its use of renewable electricity. In absolute terms, the figures in the report show a growth in emissions.

Amazon admits this, and shifts the discussion towards "carbon intensity," a ratio of emissions per dollar of revenue, which is convenient to the company because even while the company grows, that can go down.

"With all of our growth in 2021, our absolute carbon emissions increased by 18 percent in 2021," says the report; "however, importantly, our carbon intensity decreased by 1.9 percent."

I'm not at all sure that shaving a tiny 1.9 percent off your intensity really counts as more "important." Especially when you're quoting a huge increase on absolute emissions.

Creative carbon accounting

But things are much worse, when you consider the flaws in Amazon's figures. Firstly, it is true that Amazon is the world's largest buyer of renewable energy. In 2021 it paid upfront for 6.2GW of new renewable capacity, using power purchase agreements (PPAs) where a large customer essentially pays to build a wind farm or solar power plant. Amazon bought more than 20 percent of the world's total of 31.1GW of PPAs in 2021.

But look closer, and those PPAs don't actually cover as much energy as you might think. Wind and solar are intermittent sources, and Amazon is a constant, steady user. This means it is basically using expensive electricity, while giving the grid cheaper off-peak power, and leaving the grid with the headache of finding ways to store or use surplus renewables.

24-hour PPAs exist, which match the customer's consumption to actual green generation hour by hour. Google and Microsoft are experimenting with hourly-matched PPAs. As far as we can tell, Amazon is not.

This means that, in 2025, when the company says it plans to be using 100 percent renewable energy, it's pretty clear this will not be true.

Other parts of Amazon's net-zero plan heavily rely on offsetting emissions against initiatives like tree planting, which are severely criticized by environmental analysts, because they are temporary and can be wiped out.

"Nature-based solutions have a low likelihood of permanence,” according to NewClimate policy analyst Silke Mooldijk. “Trees may be cut down or lost in forest fires, which means that stored CO2 will be released into the atmosphere again.”

Other parts of the Sustainability report admit that Amazon is not actually going to be able to fix certain things, like carbon emissions from air transport: "It will take time to remove carbon emissions from heavy transportation systems, including ocean shipping, aviation, and trucking," says the report.

For these areas, Amazon wants help from the public sector: "Governments and the private sector need to come together on this important work."

Amazon says it is "at the heart of such industry initiatives and government partnerships", listing groups including a green aviation fuel buyers' club.

But if it wants to rely on government, perhaps it should be more willing to pay taxes to fund this work. The company avoids $5 billion of tax in the US, and in 2021 paid absolutely no corporation tax in Europe, despite revenues of €44 billion there. It should also, we think, rely less on government handouts to build its data centers.

The big lie

But there's one other big problem. That gaping hole we mentioned.

Earlier this year, a report from the Reveal, at the Center for Investigative Reporting found that Amazon counts the carbon of its retail operation in a completely different way to competitors such as Target and Walmart.

This affects Scope 3 emissions, the outputs from constructing the products it uses, and most importantly, the emissions from all the products it sells.

Unluckily for Amazon, retail has a heavy Scope 3 footprint. Not just the emissions from making the products you sell, but emissions from shipping them to customers, and their footprint as customers use and eventually discard them.

Microsoft found recently, that its Scope 3 emissions were fifty times bigger than its other emissions. That was based on its business selling Xboxes and other hardware.

Amazon admits to Scope 3 emissions (largely from its retail empire) amounting to 55 million tons of CO2. That's four times Microsoft's 13 million tons, but the company has a vastly bigger retail operation than Microsoft. It's the biggest retailer in the US.

Amazon does not share its detailed carbon figures, but Reveal got ahold of them, and found that Amazon manages to claim a relatively tiny carbon footprint for its retail operation because it only counts its own branded products. If you buy products through Amazon that are from another source, Amazon does not include those emissions.

That wipes 99 percent of Amazon's retail business out of its carbon books and (should you wonder) goes strictly against the Greenhouse Gas Protocols for reporting emissions.

There's a lot of detail in the Reveal report. It also points to other flaws like the fact that Amazon does not include its employees' commutes in its footprint.

But it makes the point that deleting the majority of its carbon footprint is a phony way to meet its Climate Pledge promise.

"If Amazon were counting its footprint like some of its competition, it would have to get rid of tens of millions more tons of carbon emissions – by radically transforming its business, forcing suppliers to change their own operations, paying for enormous amounts of controversial carbon offsets or maybe even confronting whether The Climate Pledge is compatible with Amazon’s business model after all," Reveal said.

DCD, along with other publications, has asked Amazon to explain the discrepancy. In the past, it has said it "follows guidance" from the Greenhouse Gas Protocol Corporate Accounting and Reporting Standard in determining its Scope 3 emissions.

One thing to look for in future is that US SEC accounting rules could be changing to force disclosure of Scope 3 emissions