Money isn't free anymore, and a lot of the things we have taken for granted in the tech industry could be over.

Apple has just thrown its hat (or its $3,500 AR headset) into the ring. Apple's Vision Pro, launched at WWDC23 and maybe the most credible AR product yet, but it could be caught out by a change in the economic climate, along with a host of hot ideas that could turn out to have just been "ZIRP phenomena."

The end of free money might spell the end of crypto, the metaverse, and a bunch of other things. And that might be a good thing.

ZIRP phenomena

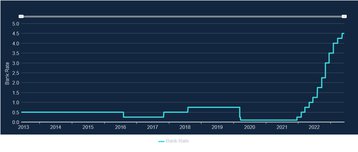

Borrowing money has been very easy for more than a decade, thanks to the Zero Interest Rate Policy (ZIRP), set by authorities like the US Federal Reserve and the Bank of England after the financial crash of 2008. Low interest rates encourage borrowing and spur economic activity, so interest rates were cut, and cut, and cut again.

For years, interest rates hovered close to zero, sometimes even going negative. This created a specific set of circumstances that shaped our current tech landscape.

Now, you cannot have avoided hearing, interest rates have been climbing, in a bid to stave off inflation. They've reached around five percent in the UK. There's no more free money, and we are told that will change everything.

Some say it could spell the end of the metaverse, fusion power startups, AI, and crypto.

Let's look at what low-interest rates did. Banks paid very little interest on savings and investments, so people put money elsewhere. Tech ventures promised a high rate of return, so a lot of money went that way.

Tech ventures have been set up to specifically require high investment to capture customers at a loss, with a potentially high return later. If interest rates were low, investors were happy to leave money invested in startups with a promise of future riches.

Facebook was a classic example - twice over. It invested heavily to gain an effective monopoly on social media eyeballs, so it could get a revenue stream of advertising. When that revenue stream started to falter (because the end of ZIRP meant companies had less money to spend on Facebook adverts), it looked for the next frontier, and decided that would be the metaverse.

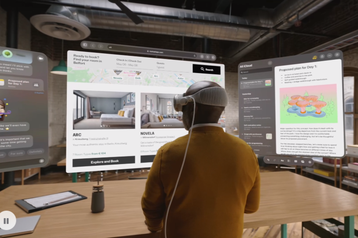

Mark Zuckerberg dived straight in, renamed the company, and planned for big investments to dominate the metaverse. It hasn't gone well. The applications were a joke, and the VR headsets were a failure, with most of them unused months after purchase.

The company has had to cut back on data center projects and now hopes that AI will be the next big thing.

But what if there is no "next big thing"?

Robert McNamee, billionaire founder of Silver Lake Partners and Elevation Partners, thinks we may not see the same kind of "next big things".

"The metaverse, AI and crypto are businesses that were created when intersest rates were around zero, which required billions of investment, against a very uncertain business outlook," he told BBC's Radio 4. "Now interest rates are five percent, none of these things are viable."

With no more ZIRP, there have been big layoffs across the sector, including high-profile companies like Meta, Google and Microsoft. Things look very different now.

The positive side

But some are seeing a positive aspect to this.

"The end of free money means more sensible investment," Steve Brierley of Riverlane told me at the recent Economist conference Commercialising Quantum Global 2023.

That conference still displayed full-blown ZIRP phenomena, including sessions on how quantum computing would solve climate change, and revolutionize fast-moving computer goods. Yes, delegates were being told that in years to come, they'd need quantum computing to shift handbags. And to get ahead, they should get on board the industry quantum flagships like IBM, D-Wave, Google, and Microsoft.

Brierley's point was that in the free money era, investors could pile money into backing a potential winner, encouraging multiple companies to attempt to build the full stack of a quantum solution. That's a massively wasteful duplication.

When money costs more, Brierley thinks they will invest more sensibly, in less risky part solutions, which build up to solve the whole problem. You will probably have guessed that Brierley's company Riverlane is exactly that, a quantum software and coordination platform, but his point is valid.

Perhaps cryptocurrencies will vanish almost entirely thanks to the end of ZIRP, and we can hope that data center expansions for speculative sectors like AI will being to be scoped on the actual likely benefits, not the hype.

That might be a welcome dose of reality.