The first commercial communications satellite in geosynchronous orbit (GEO), Intelsat I, was launched in April 1965.

Otherwise known as Early Bird, it was also the first insured satellite, with the Lloyds of London insurance syndicates providing cover against physical damage to Intelsat 1 on pre-launch.

Thankfully, COMSAT, the company that launched Early Bird, never needed to make a claim on the 34.5kg machine, which ended up operating for more than twice its expected 18-month lifespan and broadcasting the Apollo 11 moon landing to viewers on Terra Firma.

But space is dangerous and difficult, and failures costly. The first year of “turmoil” for space insurance was 1984, which saw the failure of several satellites (some later recovered), most notably the $100 million Intelsat 5.

Today there are thousands of satellites in orbit – hundreds of which are insured – but the market dynamics have changed. The number of satellites launching every year is booming; yet most are now too small to warrant insurance, while the value of the largest machines is on par with what the entire insurance market can afford.

Last year was one of the industry’s worst on record for space insurance claims, and 2024 isn’t set to be much better, with insurance providers anticipating heavy losses.

While few will shed a tear about insurance firms losing money, the result is higher premiums for operators, which could potentially hurt future satellite launches.

Insuring GEO vs LEO

Satellite insurance coverage largely falls into two buckets; cover for the launch and one year of a satellite’s operations (aka launch plus one), and in-orbit coverage that is renewed annually. In-orbit claims can be for partial losses – where the lifespan or capabilities of a machine are noticeably reduced – or for a total loss after an issue leaves a machine unsalvageable from an operational or commercial point of view.

Of the ~10,000 satellites in orbit, David Wade, space underwriter at Atrium Space Insurance Consortium (ASIC), tells DCD only around 300 are actually insured, almost all in GEO.

More than 9,000 satellites are in LEO (low Earth orbit), of which only around 50 are insured. Such insurance isn’t mandatory in many countries, meaning the decision is often down to the particular company and its financiers.

The multi-ton satellites flown to GEO, 35,786 kilometers (22,236 miles) above the Earth, can routinely require investments in the hundreds of millions of dollars. Of the 250 that are insured, the insurance kicks in at launch and lasts for much of their expected lifespan, but satellite values decline enough that, after ten years, insurance often isn’t worth the cost.

Wade says, however, that the number of insured satellites is drifting down because satellites are not being replaced at the same rate as they are retiring. The gradual decline of traditional broadcast satellites - so-called ‘bentpipe’ satellites that simply retransmit broadcast feeds - has seen the number of insurable satellites launched every year drop.

“What were once three colocated satellites are being replaced by two, or you see a couple of satellites being replaced by one which has a high-throughput payload and a heritage broadcast payload,” he says.

Consolidation in the market – including Viasat and Inmarsat, SES, and Intelsat – will also likely result in fewer GEO satellites being launched as merged operators combine and rationalize their respective networks.

Market dynamics are also changing as LEO operators take a different view to resilience and redundancy.

Large, one-off GEO satellites have traditionally been built with resiliency and redundancy in mind. That resilience comes at a premium, but the cost of failure was much higher.

LEO satellites, however, have been built cheap, with the idea that the sheer number in large constellation fleets can cover any individual failures with in-orbit spares.

While GEO operators would generally buy insurance for the launch and usable lifetime of the satellite, LEO operators are typically eschewing post-launch insurance and relying on strength-in-numbers for in-orbit operations.

“At best, they're purchasing insurance for the launch phase only,” says Wade. “The only time that they might want insurance is when they’re launching 40 or 50 of these satellites on a single launch vehicle.”

“We do see more policies covering the launch phase for constellation satellites or small satellites, but that just does not replace the income loss through traditional GEO.”

LEO can be at risk of generic failures that impact common components, and such issues do occasionally occur across entire batches of craft, forcing operators to take the financial hit. Starlink last year said it would be de-orbiting an unspecified number of its then-new v2 mini-satellites after observing unexpected altitude changes, with some demonstrating eccentric orbits. However, the speed at which smaller satellites can be built and launched means failing craft are quickly replaced.

Larger, high-resolution Earth observation satellites in LEO might traditionally buy insurance, but they too are being replaced by a greater number of smaller and cheaper machines. And, even for those smaller satellites that might want cover, it can often be hard to justify.

“It can be difficult to get insurance for some of the smaller satellites because it's just not cost-effective,” says Wade. “If you've got a satellite valued at a couple of million dollars or less, it might not make sense or be worth it to insure.”

2023 and all that

This decline in the insurance market comes at a period of a growing number of value of satellite failures, which could have a knock-on effect in the years to come.

While never a high-margin business, the market is used to paying out on smaller claims and maybe a large failure or two every year – the industry has generally hovered around a five percent failure rate since 2000. One report suggests there have been around 165 claims for more than $10 million across the history of the industry.

Though there were hundreds of satellites successfully launched into orbit, 2023 was not a good year for the space industry in terms of reliability. Issues and failures hit both a large number of smaller satellites as well as several of the industry’s marquee machines – with some of the industry’s largest-ever claims coming last year.

Jan Schmidt, head of space at Swiss insurance provider Helvetia Insurance, told Connectivity Business News last year marked “the most challenging period for the industry in over two decades.”

It saw close to $1 billion in claims and some $500m in losses for insurers; the space insurance market generally operates at a premium of $550m, meaning 2023 was a year of major losses for the industry.

“The losses in the space insurance market are unsustainable,” Melissa Quinn, general manager, Slingshot Aerospace, said after the company posted a recent market report.

“Some insurers are exiting the space industry, while the ones who remain are substantially increasing premiums to hedge against the record losses in the industry.

"While anomalies in the early part of a satellite’s life account for most of the major losses, the increased cost of insurance for overall operations is also meaningful.”

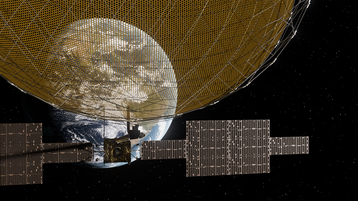

Chief amongst the casualties was Viasat, which saw its new ViaSat-3 F1 satellite suffer an "unexpected event” during reflector deployment.

The first in a constellation of three geostationary Ka-band communications satellites, F1 was set to cover the Americas, with future satellites covering EMEA, and APAC. The satellites are each expected to have a throughput of more than 1Tbps and download speeds of 100+ Mbps.

Boeing provided the satellite bus, a 702MP+ platform. The design of the satellite’s unusually large reflector is thought to be from Northrop Grumman’s ‘AstroMesh’ line of reflectors.

The company has since said it won’t replace the ailing satellite, despite the machine being expected to handle “less than 10 percent” of its planned throughput. Viasat is making a $420 million claim against the loss – the largest single claim in the history of the industry. The satellite, despite the curtailed capacity, is now live.

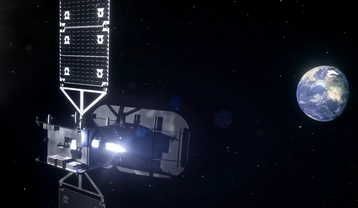

Last year, Viasat acquired rival Inmarsat. By August, in more bad news for the company, Inmarsat’s I6 F2 satellite suffered an “unprecedented” power subsystem anomaly during its orbit-raising phase – when the satellite has detached from the rocket and is rising to its desired final altitude.

The 5.47-ton I6 F2 – based on Airbus Defence and Space's Eurostar E3000e platform – was launched in February 2023 and set to have a 15-year lifespan. The satellite was to offer 4Gbps of additional Ka-band capacity to Inmarsat’s network, as well as L-band services over the Atlantic.

Viasat said it has insurance coverage of $348 million in place for the I6 F2 satellite.

While two such major unprecedented failures in a single year would be bad enough – and enough to make alarm bells go off for space insurers – the incidents turned out to be merely the beginning of the market’s problems.

Astranis’ debut Arcturus microGEO satellite – launched aboard the same rocket as ViaSat-3 – also suffered a power issue with the system that controls its solar panels.

Though the company remains in control of the satellite, Astranis estimates it can only get six to 12 hours a day of service from the spacecraft, as opposed to the expected 24.

Astranis is launching a multi-mission ‘UtilitySat’ to offer reduced capacity services in Arcturus’ wake until a full replacement can be deployed in 2025. Reports suggest the satellite was insured for around $40 million.

Though not lost, four other satellites last year were reported as suffering power issues that would likely curtail their lifespans, resulting in more insurance claims. Yahsat’s Al Yah 3, Avanti Communications’ Hylas 4, and Northrop Grumman’s two Mission Extension Vehicles (MEV-1 and MEV-2) were said to be having problems with onboard power processing units (PPUs).

The PPUs from Aerojet Rocketdyne – recently sold to L3Harris – provide the electrical power their thrusters need for station-keeping in geostationary orbit (GEO). Sources said Al Yah 3, Hylas 4, and MEV-2 have each lost one of two onboard PPUs since the issue emerged in 2022. The youngest of these spacecraft, MEV-2, launched in 2020.

The faults will not cause the machines to fail altogether, but will likely impact their 15-year lifespans. All four were built at Northrop Grumman’s facility in Dulles, Virginia. SpaceNews reported insurance claims for the four machines could total around $50 million.

It's difficult to pin down any one single reason for so many large failures and claims in one year.

“I cannot see a good reason why last year was so bad,” he says. “In some cases, there were external events that led to the loss of a satellite which could not have been predicted [and] could not be foreseen.

“There's no single thing that links them all, but for some of the other claims there are different factors that could be influencing each one; workmanship, poor quality control, design issues.”

Wade wonders if issues during Covid-19 – including supply chain difficulties, layoffs, and changes in processes – may have been a factor, but has found nothing conclusive.

A bad run of results set to continue

Wade notes the satellite insurance industry has made a loss in three of the last five years.

2019 saw the failure of the VV15 Vega rocket launch, taking with it a military observation satellite for the United Arab Emirates and resulting in a $411.21 million insurance claim – the world’s largest up to that point.

It could have been worse; that year Intelsat 29e failed after a fuel leak, serving just three of its planned 15 years. The company hadn’t insured the satellite due to the company’s reliability track record up to that point – only a handful of its machines were insured before the incident.

Despite a successful launch in December 2020, SiriusXM's seven-ton SXM-7 Satellite, built by Maxar to provide digital radio to consumers, failed during in-orbit testing. The company made a $225 million insurance claim after the satellite was declared a total loss.

The VV17 Vega rocket launch failure in 2020 saw the loss of two satellites with a combined value of around $400 million. Two Pléiades Earth imaging satellites were lost in 2022 after the VV22 Vega launch failed.

Other notable failures in recent history include 2015’s loss of the Centenario mobile communications satellite, due to be part of Mexico’s MexSat system, which resulted in a $390.7 million claim.

September 2016 saw a SpaceX Falcon 9 rocket fail while preparing a static-fire test, destroying Spacecom’s $200 million Amos-6 communication satellite and wiping out 20 years of insurance premiums for prelaunch coverage in the process.

2024 is set to look equally bleak for insurers. Several of the claims from 2023 are ongoing, and more large claims are being filed.

Reports suggest losses for the space industry this year have already surpassed $500m.

Last year, SES reported the four O3b mPower satellites it had in orbit at the time were facing power issues that would shorten the machines’ lifespans.

SES and the satellite manufacturer Boeing said satellites will have an operational life and capacity “significantly lower” than previously expected, but five machines yet to launch would be upgraded, with two more satellites launched to cover the issue.

In its April quarterly earnings report, SES said it was “continuing to engage with insurers” over a $472m claim relating to O3b mPower satellites 1-4.

In May, SpaceIntelReport reported Ligado Networks had declared its SkyTerra 1 mobile communications satellite a total loss and filed a $175m insurance claim, later confirmed to DCD. Launched in 2010, the five-ton GEO satellite featured 152 L and Ku-band transponders to provide 4G-LTE open wireless broadband network coverage to North America.

However, in good news, Yahsat’s Thuraya-3 communications satellite seems to have recovered from an issue. The satellite, which provides services over Asia, suffered an outage of its communication payload in April. In May, the company said it had managed to successfully recover services across a large part of the region – though seemingly not Australia. The Boeing-made L-Band satellite was launched in 2008 with a 15-year planned design life.

Market dynamics changing; bad for insurers, bad for operators?

ASIC’s Wade says changing market dynamics have seen the premium base eroded at the same time that high-end satellites are increasing in value. The market has “become much more volatile,” he says.

His organization has a combined capacity of $45m, meaning it can underwrite any single launch or satellite up to that value. Across the 35 other space insurance providers globally, there’s close to $600m of capacity.

But some of today’s large satellites are routinely being valued at more than $400m. It only takes a couple of satellite failures to wipe out the entire market, and such events seem to be happening increasingly often.

“Satellite values have gone up, and the premium has gone down,” Wade says. “It used to be that we made enough premium to pay two total loss claims and still make a profit. That's certainly not been the case for the last decade.

“Now, if the largest satellites were to fail in any one year, that's usually going to be enough to tip the market into a loss for the year.”

Wade notes that with the growth in lower-value satellites, the premium base for insurers has dropped. And when the really high-value machines get lost, the loss ratio of claims to premium goes through the roof.

“A single event throws the market into a loss. That is getting attention, and some firms are questioning whether it's valuable as a line of business. If we keep on losing money, they’re going take that to insurance capacity and give it to a more profitable line of insurance.”

While companies focused on delivering connectivity from space may be more concerned about their own operations than the profit margins of insurance firms, a bad year for insurers can have knock-on effects in the space industry.

Inevitably, the only way to reduce losses is to either raise prices for operators, or have more launches and satellites to cover. Richard Parker, co-head of space at underwriter Canopius, told SpaceNews last year his firm raised prices across the board after the Viasat-3 announcement – before the other notable failures later in the year.

“We know that right now the number of risks insured isn't going to increase for the foreseeable future,” says Wade. “The only room that we have to maneuver is to increase rates to try to get the premium level back to a level where it can pay out the claims we're seeing.”

Ideally, Wade says he’d like to see around 50 launches a year, where he could underwrite $20 million on each launch; and of those 50 launches, one would fail. Under that market dynamic, the risk is spread and insurance firms can make profit and support some failures.

“But what we are now seeing is maybe 20 launches a year,” he says. “The majority of those might be small satellites or constellation launches, where we might have a line of $10m; we might have a couple of Earth observation satellites that are $20m; and a couple of GEO commsats for $20-25m.

“And then you get this single, massive value satellite comes along where everybody needs to write a big line to get the thing insured, and you end up with one single satellite that's $40m exposure. And if that one goes wrong, suddenly the whole book is blown.”

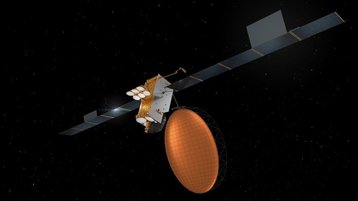

He notes that microGEO satellites – the smaller machines with smaller coverage areas being sent to GEO – may be a good thing for the industry and are “very insurable” from his perspective.

These machines – like those from Astranis – are lower cost than their high-throughput cousins, but might only provide coverage to a single country or region. Astranis has contracts for eight machines to provide coverage over the Philippines, Mexico, Argentina, Thailand, the US, and Peru. Swissto12 is another microGEO player and has secured contracts with the ESA and Viasat's Inmarsat.

“I would prefer to see 20 of these microGEO satellites launched to fill particular needs rather than a company struggling to raise the finance to buy an underutilized big satellite,” says Wade.

More failures and claims coming?

Things may get worse before they get better.

Through 2024 and beyond, a number of new launch vehicles will enter service, heightening risk at a time of increased space weather and reduced satellite reliability.

Currently, there are no dual-launch rockets in operation after the retirement of the Ariane 5 launch vehicle, meaning the largest satellites are being launched one-by-one. However, a number of new dual-launch vehicles are set to come into operation soon, potentially meaning all of the space insurance market’s underwriting capacity will be attached to one launch, adding greater risk to the market.

Increasingly turbulent space weather could also cause more issues.

The sun is heading towards the peak of its 11-year solar cycle, meaning more solar flare activity is likely over the next few years. Significant weather events that damage a large number of satellites could easily have a major impact on constellation providers, leaving them with limited coverage, reduced revenue, and no cover.

SpaceX lost up to 40 Starlink satellites in the wake of a geomagnetic storm in February 2022 – partly due to increased drag impacting orbit-raising maneuvers. Starlink seems to have held up better in the wake of recent space weather.

“Major geomagnetic solar storm happening right now,” SpaceX CEO Elon Musk posted on X (formerly Twitter) in May 2024 amid major solar activity. “Biggest in a long time. Starlink satellites are under a lot of pressure, but holding up so far.”

This increasingly unpredictable weather is occurring at a time when satellite operators are also using newer, less resistant chips, which can potentially push up failure rates.

“I think we're seeing issues with some of the new space players, where component parts are maybe not tested as thoroughly as they used to be,” says Wade.

The desire to bring down the cost of a satellite is resulting in moves towards commercial off-the-shelf components, while the desire to improve satellite capacities means greater use of more modern chips that might not have been hardened against space to the same extent as older, less capable units.

“We're seeing the density of those devices getting smaller and smaller, and their susceptibility to space weather events becomes more critical,” says Wade.

No insurance, no innovation

While he hopes the space insurance industry makes money in 2024, Wade concedes it’s “not going to be a great year” due to the low number of GEO communication satellites launching this year.

Some insurers have already given up. Brit, which offered more than $50m of space insurance capacity, left the market last year. AIG ($20-25m) also left last year, with Swiss Re, Allianz, and Aspen Re all leaving the space insurance market in 2019.

Insurance Insider has suggested other players are “teetering on the edge” in fragile positions, with Brit the “tip of the iceberg” as others potentially slowly withdraw their capacity from the market in the future.

Indian insurance specialist Tata AIG, however, announced it was entering the space in May 2024.

“If we continue to see losses, there will just be more and more insurers that start to pull out as less insurance is available, the competition dries up, and prices rise in response,” Wade says.

Between 2012 and 2021, annual investments in the space sector increased from $300 million to $10 billion, according to McKinsey. But if commercial space players can’t get or can’t afford the insurance banks or investors might require to finance new machines, projects may not be able to (literally) get off the ground.

“We're already seeing some insurers say that they're not prepared to insure satellites in LEO. My concern is that if the insurance isn't available, then the finance isn't available, and that really stifles innovation,” Wade warns.

Longer term, however, he still sees “great prospects” thanks to the growing commercialization of space – including a number of space stations and lunar missions.

“We know that space is required in everybody's daily life, and it has an incredibly important role to play,” he says. “It will be increasingly commercial - we just need to get through the next two or three years to get there.”