Struggling UK AI chip maker Graphcore is reportedly speaking to potential buyers over a sale that could value the business at over £400 million ($504m).

The company, which has sustained heavy losses in recent years, is in talks with larger tech companies over an acquisition, according to a report in The Telegraph.

Graphcore sale: who will buy AI chip maker?

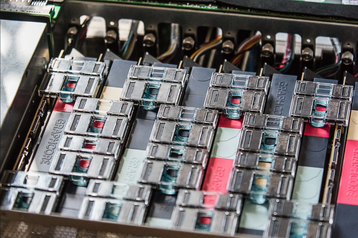

Bristol-based Graphcore makes AI accelerators it calls Intelligent Processing Units, or IPUs. These are marketed as an alternative to GPUs produced by Nvidia, which have underpinned the AI revolution of the last 18 months.

The company’s technology is said to compare favorably to Nvidia’s, with a Towards Data Science article from 2022 claiming its Bow IPUs can outperform Nvidia’s A100 GPU at certain AI workloads.

But despite this, the company has struggled to cash in on the AI boom. Its 2022 financial results, reported in October, showed pre-tax losses grew 11 percent over the year to £161 million ($204m).

At the time, Graphcore said it was facing “material uncertainty” over whether it could continue trading, and was seeking fresh investment.

The Telegraph reports that this has, so far, been unsuccessful, leading the company’s directors to explore a sale instead.

Graphcore suffered a further blow in November when it was forced to pull out of China, a market previously targeted as a major growth area for the company, due to US export controls on AI technology.

The Telegraph report says Graphcore investors have significantly marked up the value of their stakes in the company, indicating a sale could be on the cards. It suggests UK chip design giant Arm, or its major shareholder, Japanese conglomerate SoftBank, as potential buyers. SoftBank is reportedly planning its own separate $100bn AI chip venture.

A sale for £400 million would be a far cry from the heady days of 2020, when Graphcore was valued at £2.1 billion ($2.77bn) following a £175 million ($222m) funding round. In total, the company has raised more than £562 million ($710m) since it was founded in 2016.

DCD has contacted Graphcore for comment on the report.

UK government could intervene in Graphcore sale

Any sale of Graphcore to a foreign buyer is likely to come under scrutiny from regulators. Like many other countries around the world, the UK has in recent years attempted to protect its domestic semiconductor IP and supply chain following the 2021 global chip shortage, which left companies in many industries without access to vital hardware.

In November 2022 the government blocked the purchase of the UK’s largest chip plant, Newport Wafer Fab, by Dutch company Nexperia, using its powers under the National Security and Investment Act. It said it took this decision because Nexperia is a subsidiary of Chinese company Wingtech, which has close links to the government in Beijing.

Nexperia subsequently announced it was selling Newport Wafer Fab to US manufacturer Vishay Intertechnology for $177m.