European Edge company AtlasEdge has secured a new €725 million ($800m) credit facility.

The company this week announced that it has secured a scalable facility underwritten by mandated lead arranger ING Bank, as well as ABN Amro, Crédit Agricole CIB, The Bank of Nova Scotia, National Westminster Bank Plc, Banco Santander, and UniCredit Bank AG.

The package consists of €525 million ($579m) in committed debt financing and a further €200 million ($221m) uncommitted accordion. The financing also includes sustainability-linked targets focused on efficiency and renewable energy usage.

The company said the new facility provides AtlasEdge with ‘considerable firepower’ to execute further strategic M&A and build new sites throughout Europe’s key markets.

“We are delighted to have partnered with a group of top-tier financial institutions whose ambition matches our own and are willing to continue to support us in the future,” said Ron Huisman, CFO of AtlasEdge. “This is a bespoke and highly sought-after facility with in-built flexibility that allows us to move rapidly to realize new growth opportunities."

AtlasEdge CEO Giuliano Di Vitantonio added: “We are pleased to have closed our inaugural large-scale debt financing, which will enable us to continue to meet surging customer demand for digital infrastructure closer to the end user. The backing of ING and the wider syndicate represents a strong endorsement of the AtlasEdge mission to build a pan-European Edge data center platform.”

Sicco Boomsma, managing director within ING’s TMT sector financing team, said: “Borrowers are reminded that, at a time where the real estate and leveraged-loan markets have become more challenging, there is still significant liquidity available from infrastructure-focused lenders. ING’s sector expertise and broad European network was critical in structuring, underwriting, and executing this innovative, multi-jurisdictional financing. The multi-asset infrastructure financing provides significant flexibility to the underlying pool of Edge assets. ING’s appetite for the data center sector remains strong and we are proud to support AtlasEdge’s European Edge data center expansion plans.”

Ropes & Gray LLP served as legal advisers to AtlasEdge. CMS Cameron McKenna Nabarro Olswang LLP served as legal due diligence advisor to the Lenders, with Analysys Mason serving as commercial due diligence advisor and Royal HaskoningDHV as technical due diligence advisor, and EY as financial model auditor to the Lenders.

Formed as a joint venture between telecoms company Liberty Global and digital infrastructure fund DigitalBridge in 2021, the company plans to operate 100 Edge data centers across Europe. Digital Realty has also invested in the company.

The deal brought together DigitalBridge’s Edge assets and Liberty Global's real estate portfolio, with several Liberty Global operating companies acting as anchor tenants; Virgin Media in the UK, Sunrise-UPC in Switzerland, and UPC in Poland. Digital Realty has also invested in the company.

In November 2021, Atlas acquired twelve data centers across Europe from Colt Data Centre Services (DCS). 2022 also saw AtlasEdge acquire a data center in Leeds, UK, and Datacenter One in Germany, adding four facilities across Stuttgart, Leverkusen, and Dusseldorf.

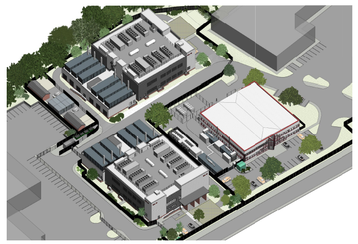

It is also building two data centers in Manchester, UK.