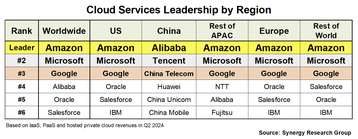

AWS, Microsoft, and Google continue to dominate the public cloud market in all parts of the world other than China, according to a report from Synergy Research Group.

The market shares of AWS, Microsoft, and Google were 32 percent, 23 percent, and 12 percent respectively. No other company could claim more than four percent.

Following the big three were Alibaba, Oracle, and Salesforce.

The top three cloud provider rankings remained the same in all regions, except for in China, where local providers prevail.

In China, the top three spots were occupied by Alibaba, Tencent, China Telecom, and Huawei. In fact, all top ten players were Chinese firms.

In the rest of the world, Oracle, Salesforce, and IBM jostled for fourth position.

Geographically, the US remained the largest cloud market, followed at a distance by China, which was in turn followed at a distance by Japan, the UK, Germany, and India.

“This is quite simply a game of scale. Between them Amazon, Microsoft, and Google now have a global network of over 560 operational hyperscale data centers. In Q2 alone they invested over $48 billion in capex, most of which went towards building, equipping, and updating their data centers and associated networks,” said John Dinsdale, a chief analyst at Synergy Research Group.

Dinsdale added that there is still opportunity for local companies to compete in their home market, where they can focus on specific services and demonstrates a competitive advantage relative to the industry giants.

Earlier this week, another Synergy report named Northern Virginia, Beijing, and Dublin as the top three hyperscale locations.

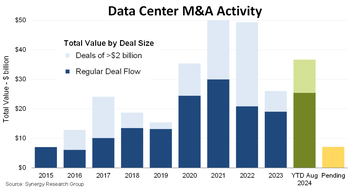

Data center M&A deals to reach record levels

Elsewhere, Synergy Research Group said mergers and acquisition deals were on the rise again and forecasted to reach record levels this year.

In 2024, M&A deals are poised to pass the $40 billion mark, following a relative lull in 2023.

Total deals closed so far in 2024 are valued at $36.7 billion, with another $7.1 billion agreed but not formally closed.

2021 and 2022 were the peak years in terms of the aggregate value of all formally closed deals. The total value of deals closed in both years was around $50 billion.

The report attributed the peak in 2021 and 2022 to the four biggest deals ever seen in the data center industry, with each being valued at $10 billion or more. These were the acquisitions of CyrusOne, Switch, CoreSite, and QTS.

The majority of the deals come from company acquisitions, but the numbers also include minority equity investments, joint ventures, share sales, and acquisition of land for data center development.

“There has been an inexorable rise in the demand for data center capacity, driven by cloud services, social networking and a range of both consumer and enterprise digital services," Dinsdale said. "The rise of generative AI is adding a further boost to demand. Specialist data center operators have either not been able to fund those investments themselves, or they were not prepared to put their balance sheets at risk."

He added that data centers have become a “long-term safe haven for investments”, causing a huge influx in private equity. The report said private equity has accounted for between 85 to 90 percent of the value of closed deals since 2021.