UK real estate firm British Land has sold a portfolio of data centers.

In a business update posted this week, the company said it exchanged contracts on the sale of an office and data center portfolio for £125 million ($152.2m).

The deal represented a net initial yield (NIY) of 4.6 percent, which delivered an internal rate of return (IRR) of 8.2 percent per annum since acquisition in 2007.

Simon Carter, British Land CEO, said: "I am pleased with the continued momentum in the business. Operationally we are seeing strong leasing activity which reflects the exceptional quality of our portfolio and has resulted in our recent upgrade of the expected ERV growth in retail parks. We have also strengthened our balance sheet in the period and continue to actively recycle capital with the disposal of non-core assets ahead of book value."

Details of the portfolio or the buyer weren’t shared.

However, in July reports surfaced that Savills was seeking buyers for a portfolio of Vodafone-occupied office and data center buildings across London owned by British Land.

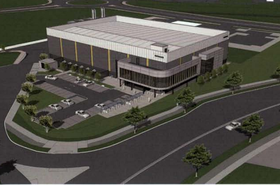

Known as the Network Portfolio, the portfolio comprised six facilities spanning a total of 260,000 sq ft (24,155 sqm).

Later reports suggest US real estate firm Realty Income was in negotiations to acquire the facilities. Realty Income hasn’t announced any acquisition deal.

The Network properties are let to Vodafone Enterprise UK on leases expiring in April 2032. They generate total passing rent of £6.1 million ($7.7m) per annum. The properties include several data centers across London, many at sites previously occupied by Cable & Wireless, as well as the recently-renovated Smale House office building.

EGI previously said the sites are being marketed with scope for medium to long-term redevelopment potential for uses including student and residential, as well as more offices and data centers.

DCD has reached out to British Land for more information.