A global trends report from CBRE has said emerging markets are key to meeting increased demand for power.

Emerging markets, due to their availability of land and power, are attracting investment from companies looking to secure data center capacity, the real estate firm said.

These markets include Northern Indiana, Idaho, and Boise in the US; Mumbai, India; Rio de Janeiro; Brazil; and Oslo, Norway.

Kevin Restivo, head of data centers research, Europe at CBRE, said: “Hyperscaler ambitions and lower power costs have driven rapid growth of markets such as Oslo, given its accessibility and economic importance. In some cases, this makes them hotspots of data center construction."

Rising rental rates drive investment in emerging markets

Declining vacancy rates in primary markets such as Northern Virginia, Chicago, Dallas-Fort Worth, Santiago, London, and Amsterdam have led to increased rental prices.

Some regions have experienced up to 50 percent increases since Q1 2023, with North America seeing the highest increase of 20 percent year over year. In Chicago, rates increased 33 percent, up to $155-165 per kW per month in Q1 2024 from $115-$125 per kW per month in Q1 2023.

Singapore has one of the highest rental rates in the world, asking for more than $330 per kW per month. Prices in Santiago have reached $500 per kW per month.

As a result, increased rental prices in primary markets have contributed to increased interest in secondary markets.

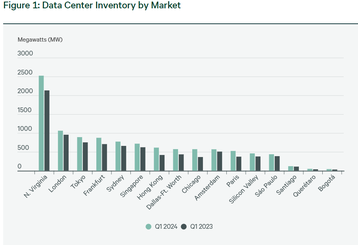

Data center inventory climbing in markets with access to power

Power constraints have been prevalent across FLAPD markets and North America.

Andrew Jay, head of data center solutions at CBRE Europe, said: “Power and land shortages, combined with increased regulation, are the most prominent inhibiting factors when it comes to data center development in Europe."

The report said data center inventory is climbing in markets with access to power, particularly those where local governments are integrating renewable energy into the grid or where utility companies are upgrading transmission lines.

In Paris, inventory increased by 40.6 percent from Q1 2023 to Q1 2024. Chicago saw an increase of 57.2 percent - the biggest increase in any North American market.

Inventory in Dallas increased by 31.9 percent from Q1 2023 to Q1 2024, with up to 573MW of IT capacity. This makes it the second-largest US market after Northern Virginia.

Dallas is also experiencing record-high preleasing and construction levels. The city has 372MW already under construction and 91.8 percent of that is already preleased.

Vacancy rates continue to decline, AI is the cause

Artificial intelligence has been a contributing factor to record levels of data center demand, according to the report.

Particularly across Europe, AI-specific requirements have driven the colocation data center markets to new heights.

As a result, demand continues to outstrip supply. In Northern Virginia, vacancy has fallen to 0.1 percent in Q1 2024, even though inventory grew by 21 percent.

In Amsterdam, vacancy has dropped to 11.5 percent in Q1 2024 from 19.4 percent a year earlier.

Pat Lynch, executive managing director for CBRE’s data center solutions, said: “Global power shortages are driving an unprecedented surge in data center rental rates, particularly in North America, while AI advancements are having a significant impact on data center demand

“Preleasing data center space well in advance of completion is commonplace across the globe, which underscores the robust demand in the market and the need for ongoing investment in development."

Earlier this year, CBRE reported that Europe’s secondary data center markets would reach 273MW of new supply, yet still be outstripped by demand.

More in Investment / M&A

-

-

-

Discussion Networking break