Update: An earlier headline of this story said Crusoe was building a single 100MW facility. This has been updated.

Crusoe Energy, a company best known for mining cryptocurrencies via flared gas, is to start building permanent data centers for AI customers.

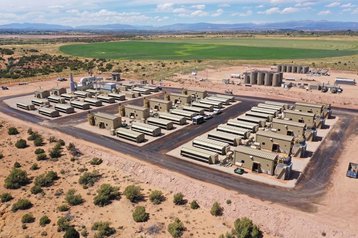

Founded in 2018, Crusoe first launched with a service to deliver containerized data centers to oil wells in the US, where they would harness natural gas that would otherwise be "flared off" and wasted.

Originally the company was using the energy for Bitcoin mining, but later extended its compute services to HPC and AI through its Crusoe Cloud offering.

While it continues to power a significant part of its cloud offering through flared gas sites, the company has also signed colocation deals with third parties.

Now, as it looks to embrace the current AI boom, Crusoe is planning to build its own facilities and host AI infrastructure for third companies.

“We're moving very quickly into building the AI infrastructure, and we've got a big pipeline of opportunities we put together,” Crusoe co-founder, president, and COO Cully Cavness told DCD recently, adding that the company is aiming to deliver “gigawatts of new data center capacity.”

“Some of that we're placing into third-party colocation partners… [or] building our own infrastructure. And increasingly, this is looking like large, permanent building structures rather than the modular data centers that we used in the past,” he added.

Cavness said the company has designed a ‘new high-density data center form factor’ based around being able to get the maximum number of GPUs into a single cluster.

The company has come up with a 103MW data center design, comprising four 25MW wings. Cavness said the sites will be able to host 100,000 GPUs on a single integrated network fabric.

[An earlier version of this story said the company was building a 100MW data center, the company has since clarified its design can support up to 100MW]

This design will be optimized for direct-to-chip liquid cooling or rear door heat exchangers, but the design is flexible enough to include air cooling.

The company will host both its own hardware for its Crusoe Cloud in addition to third-party hardware.

Crusoe is yet to disclose locations or customers for its initial building project, but DCD understands the company is close to announcing a major deal, with more details to be revealed soon.

From flaring modules to bricks and mortar

Crusoe’s move to more permanent hosting locations began late last year when the company announced a deal to locate a number of GPUs in atNorth's ICE02 data center in Iceland. The company has also partnered with Digital Realty.

In its most recent ESG report published last month, the company said it has around 200MW of deployed capacity; around a third of its Crusoe Cloud offering was powered by gas flare sites, while the remainder was powered by third-party data centers.

The company said it consumed around 460GWh at grid-connected locations and third-party sites during 2023 – around 65 percent of that was from geothermal or hydroelectric sources, the rest was offset via renewable energy purchases.

As well as oil pipelines, the company now offers the service for other stranded energy assets, potentially including solar or wind farms generating excess power that would be "curtailed."

The company has said it has a pipeline of potential renewable site projects of around ~4GW, and expects to have its first such project under construction in 2024.

“We are working on the launch of our first Digital Renewable Optimization (DRO) site in 2024, which will give us access to more than 100MW of behind-the-meter wind power,” the company said in the report. “In addition, we are looking at opportunities to build out on-site renewable generation capacities at our sites to support the energy transition and sustainably power our digital infrastructure.”

When asked about locations, Cavness told DCD the company is focused on North America and Europe. He added Latin America and the Middle East “make sense” over time, while Asia would be “further down” the roadmap.

Funds and friends

Crusoe has raised more than $600 million in funding across multiple funding rounds, with investors including Mubadala and the Oman Investment Authority, Valor Equity Partners, Founders Fund, Bain Capital Ventures, Coinbase Ventures, G2, and others.

Cavness told DCD it has raised $700 million in equity to date and more than $1 billion in non-dilutive capital. The company is exploring its next funding round and the next wave of credit financing.

Crusoe has previously acquired cryptomining firm Great American Mining, manufacturing firm Easter-Owens, and some assets from cryptomining firm Compute North, The company has also signed a patent sharing agreement with crypto firm Lancium, giving Crusoe access to IP for ramping data center load up and down.

Last year Crusoe secured $200 million to buy 20,000 Nvidia GPUs to power its cloud offering, and said it will deploy HPE Cray XD supercomputers customers can use to train large-scale AI models. On its website today, Crusoe offers access to Nvidia H100, A100, L40S, and A40s GPUs.

Former Digital Realty CEO Bill Stein is on the company’s board of advisors. The company has hired former Google SVP Nadav Eiron as well as 365 Main co-founders Chris Dolan and Jamie McGrath.

The end of flaring or crypto for Crusoe? Probably not

The company has deployed dozens of its gas flare modules along pipelines in the US, as well as two sites in Argentina. In 2023, the company deployed 12 projects in the US, for a total of 33 across six states – Colorado, Montana, New Mexico, North Dakota, Utah, and Wyoming, which in all generated 635,000MWh of electricity last year.

Cavness said that today, Crusoe Cloud accounts for around half of Crusoe’s revenue, and could reach around 70 or 80 percent by the end of the year.

“The main focus right now is investing in the AI business,” Cavness told DCD. “We’re not going to turn off that [crypto] business, but there’s just a once-in-a-lifetime opportunity on the AI side.”

Even if it isn’t focusing on crypto, that doesn’t mean the company is planning to move away from flaring sites or natural gas.

In its ESG report, Crusoe said the company is evaluating how its flare mitigation technology could be deployed to other sources of methane emissions, such as open waste landfills.

“Crusoe has signed term sheets to develop a post-combustion carbon capture and sequestration (CCS) and a small modular nuclear reactor project over the coming years in line with our goal to support and accelerate the next generation of climate-aligned energy sources,” the company said.