Dutch transmission system operator TenneT is to invest in thousands of kilometers of new transmission infrastructure across the Netherlands and Germany as it looks to update the grid.

TenneT is a transmission system operator (TSO) in the Netherlands and a large part of Germany. Controlled and owned by the Dutch government, it is the national electricity transmission system operator of the Netherlands, responsible for overseeing the operation of the 380 and 220 kV high-voltage grid throughout the Netherlands and its interconnections with neighboring countries.

In the first six months of fiscal year 2024, TenneT said it had increased its investment activity, spending €4.6 billion ($4.97bn) on growth compared to €3.5 billion in the same period last year.

The organization said the increase was mainly related to higher investments in its 2GW offshore program and several onshore projects.

TenneT noted that the overall costs for ancillary services such as redispatch, grid losses, reserve power plants, and control power, decreased in the first half-year of 2024.

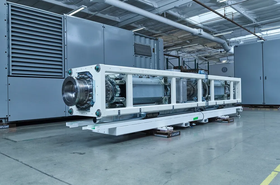

From now until 2045, TenneT plans to construct more than 3,500 kilometers of new grid connections on land and at sea in Germany, and 2,500 kilometers in the Netherlands. This will require a “significant” expansion of TenneT's onshore grid, the organization said, with hundreds of new transformers and dozens of new high-voltage substations, while also building an integrated offshore grid in the North Sea.

TenneT CEO Manon van Beek said: “To achieve the 2030, 2045, and 2050 climate milestones and meet our customers' immediate needs, we fully facilitate the electrification of industry, businesses, homes, hospitals, and public transport by delivering new infrastructure.”

He continued: “According to plan, we will further scale up our investments in expanding and maintaining the network on land and at sea in 2024. Not investing in the power grid is not an option as the social and economic cost of grid congestion, redispatch cost, and not having access to electricity are much higher than the grid investments required.”

To make better use of the current grid, TenneT said it is applying Dynamic Line Rating to both 380 kV and 110-150 kV connections, a technology that provides up to 30 percent more transmission capacity on an increasing number of connections.

TenneT also noted that negotiations to sell the organization to the German state have been terminated. It is now exploring alternative funding solutions for the group’s German activities, on the public and private capital markets.

TenneT’s CFO Arina Freitag said: “TenneT has started preparations for alternative financing. In the meantime, TenneT and the Dutch state have agreed upon a €25 billion ($27bn) shareholder loan facility to support the planned investments in the Netherlands and Germany for 2024 and 2025.”

In the Netherlands, Amsterdam is a major data center hotspot. Germany, Frankfurt is another one of Europe’s main markets. As well as the Netherlands, TenneT is a TSO in Hesse, the state where Frankfurt is located.

TenneT noted that “increased demand” is causing long waiting times, especially on its regional 110-150 kilovolts (kV) grids in the Netherlands.

“Unfortunately, this will remain a critical situation for the time being,” the group said.

European energy federation Eurelectric has previously said Europe needs to increase its distribution grid investments from an average of €33bn ($35.79bn) to €67bn annually between 2025 and 2050.