Global semiconductor revenue saw a year-over-year decline of 11 percent in 2023 to $534 billion, according to a new research report from Gartner.

In total, the combined semiconductor revenue of the top 25 semiconductor vendors declined by 14.1 percent in 2023, with only nine of those 25 companies posting revenue growth during the same period.

Intel topped Gartner’s table of best-performing semiconductor vendors in 2023, posting revenues of $48.7 billion and overtaking Samsung Electronics whose revenue reached $39.9bn last year. However, both these figures represent a decline, with Intel experiencing a 16.7 percent reduction in revenue and Samsung Electronics seeing its revenues reduce by 37.5 percent. Qualcomm, which placed third in Gartner’s table, also saw a year-on-year downturn, with revenue declining by 16.6 percent to $29bn.

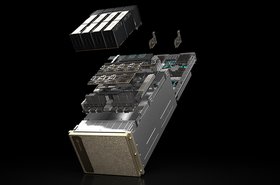

Of the top five companies, only Broadcom and Nvidia – which ranked fourth and fifth consecutively – saw revenue growth. Broadcom was up 7.2 percent to post revenues of $25.6bn, while Nvidia, driven by its strength in the AI market, saw its revenue grow by 56.4 percent to total $24bn.

Revenue for memory products also declined in 2023, falling by 37 percent and experiencing the biggest decline of all the segments in the semiconductor market. DRAM revenue also declined by 38.5 percent to total $48.4bn, while NAND flash revenue decreased from 37.5 percent to $36.2bn.

“While the cyclicality in the semiconductor industry was present again in 2023, the market suffered a difficult year with memory revenue recording one of its worst declines in history,” said Alan Priestley, VP analyst at Gartner. “The underperforming market also negatively impacted several semiconductor vendors... with 10 experiencing double-digit declines.”

Despite the downturn experienced by vendors during 2023, in December Gartner published a report predicting that semiconductor revenue in 2024 would reach $624bn, with the bounce back being largely fueled by a growing demand for chips that can support AI workloads and growth in the memory market.