Princeton Digital Group (PDG) has announced plans to expand its data center capacity in Mumbai and Chennai, India.

The expansion will see the firm invest $1 billion into the country and will bring its India portfolio to 230MW of capacity.

Located in Mumbai, MU1 currently offers 48MW across two buildings. PDG plans to add three new facilities, bringing the total campus capacity to 150MW across 15 acres of land.

The first phase of the expansion is scheduled for delivery in 2026.

Once complete, the data center is contracted to be powered 50 percent by renewable energy.

PDG signed an agreement with Tata last year to procure solar energy for its Mumbai data center.

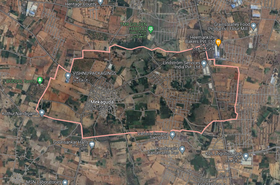

In addition to the Mumbai expansion, PDG will build its first Chennai campus in the northern Chennai Metropolitan area.

Dubbed CH1, the campus will span 9.3 acres and offer 72MW of capacity. Other details have not yet been shared.

“Over the last 18 months, AI has completely transformed the data center landscape. First, we saw the explosion of demand in North America, followed by the initial wave of AI-driven demand in Asia," said Rangu Salgame, chairman, CEO, and Co-founder at PDG.

"PDG has been a major beneficiary of this initial surge, and our capacity and capabilities in India have been a significant factor in our success. India is well-positioned to be a global AI leader, and we are determined to play an important role in making that happen. As one of the fastest growing data center operators, our $1 billion investment in India is a testament to our deep commitment to the country’s AI and cloud ecosystems”

PDG was set up with the help of Warburg Pincus in 2017 and operates data centers in China, Singapore, India, Indonesia, Malaysia, and Japan. Mubadala is also an investor.

PDG recently announced plans for a 500MW expansion strategy across Asia, including a $5 billion investment in Malaysia, Indonesia, and India.

STT GDC and AWS have both recently made announcements to invest in India.

STT GDC, AdaniConneX, NTT, Nxtra, CtrlS, Colt, and Tata all have a presence in Chennai. Mumbai is home to operators such as Digital Edge, Iron Mountain, NTT, CtrlS, Nxtra, Tata, and Equinix.

A report from DC Byte earlier this year said Navi Mumbai and Central Mumbai were two rapidly emerging markets in the APAC region and updates to Maharashtra’s IT policy have boosted data center development in the city.