Quantum computing firms IonQ, Rigetti, and D-Wave have announced their Q2 2024 earnings results.

All three companies continued to post losses as they seek to build systems capable of surpassing classical supercomputers, though some saw those losses narrow slightly.

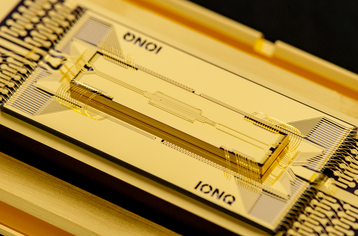

IonQ: Revenue up, net losses down, another govt contract win

For Q2 2024, IonQ reported $11.4 million in revenue; up 106 percent on Q2 2023’s $5.5 million.

Net loss for the quarter was $37.6 million and adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) loss was $23.7m; Q2 2023 saw a net loss of $43.7m and adjusted EBITDA loss of $19.4m.

During Q1 2024, IonQ recognized revenue of $7.6 million for the first quarter, compared to $4.3 million in the prior year. Net loss was $39.6 million and adjusted EBITDA loss was $27 million.

“This was a tremendous quarter for IonQ, with the company posting revenue well above the high-end of our guidance range and leading the industry in technical innovations that have brought the quantum era within reach,” said Peter Chapman, president and CEO of IonQ.

“Specifically, the second quarter saw the launch of our accelerated technical roadmap, our demonstration of 99.9 percent fidelity using our next-generation barium qubits, and our invention of an industry-first partial error correction scheme, a new technique that could allow much larger applications to run on near-term quantum systems.”

The company secured $9 million in new bookings for the second quarter. The company announced it was to supply the Applied Research Laboratory for Intelligence and Security (ARLIS) with a networked system for ‘blind’ quantum computing, where the system remains ‘blind’ to what information is being processed through them.

The initial phase of the $40m contract is a $5.7 million award for the design of the quantum computers based on IonQ trapped ion processors, due for completion by the end of the year. ARLIS plans to have two systems built based on the initial IonQ design.

IonQ said it also extended its contract with Amazon Web Services (AWS) to continue to offer its quantum computers via Amazon’s quantum service, Braket.

For Q2 2024, total operating costs and expenses for the second quarter were $60.3 million, up 56 percent from $38.6 million in the prior year period, but within the company's plan.

Rigetti: Revenue flat, losses drop slightly

Rigetti posted Q2 revenue of $3.1 million. Operating loss for the quarter was $16.1 million, while the net loss was $12.4 million. This compaed to revenue of $3.3 million and a net loss of $17m in the same period 12 months ago.

Q1 of this year saw the company post $3.1 million in revenue, an operating loss of $16.6 million, and a net loss of $20.8 million.

“We are seeing very promising results both with fidelity and speed on our current systems which leverage the underpinning technology of our upcoming Ankaa-3 system. Our 24-qubit system is performing in the 99 percent range for 2-qubit fidelity,” said Dr. Subodh Kulkarni, Rigetti CEO. “Our gate speeds are 60-80ns, making our systems twice as fast as other superconducting quantum computing players, and 3-4 orders of magnitude faster than trapped ion and pure atom quantum computing systems. We are confident that we can translate this level of performance to our 84-qubit chip.”

Total operating expenses for the quarter were $18.1 million

The company this month announced the introduction of a new quantum chip fabrication process, known as Alternating-Bias Assisted Annealing (ABAA). Rigetti said ABAA allows for more precise qubit frequency targeting, enabling improved execution of two-qubit gates and improvement in performance, which both contribute to higher fidelity. This technique is now being used to fabricate chips for Rigetti QPUs, including the Novera QPU and the upcoming Ankaa-3 system.

On future revenues, Kulkarni said: “When we sell on-premise QPU systems, typically we are pricing them in the neighborhood of $200,000 to $250,000 per qubit. So a 24-qubit system roughly is in the $5 million neighborhood. And timing of that is always difficult to predict,” adding that such deals can be “lumpy” when dealing with budgets from governments and national labs.

He continued: “So it is going to be lumpy for the foreseeable future. We are in that $3 million and $3.5 million range today for sales per quarter, primarily because most of the revenues are coming from DOE, DOD, and the UK government contracts. And those are more predictable in nature. But when it comes to on-premise QPU orders and deliveries, it's going to be lumpy until the business becomes large enough, where we get some kind of a smoothing effect.”

D-Wave: Year-on-year losses narrow

Revenue for Q2 2024 was $2.2 million, an increase of $500,000, or 28 percent, year-on-year. Net loss for the quarter was $17.8 million, a decrease of $8.4 million from Q2 2023’s $26.2 million.

Adjusted EBITDA loss for the quarter was $13.9 million, a decrease of $1 million from Q2 2023’s of $14.9 million. The company said the improvement was due primarily to higher gross profit and lower operating expenses.

D-Wave’s Q1 2024 revenue was $2.5 million; net loss for the quarter was $17.3 million, while adjusted EBITDA loss was $12.9 million.

“Our second quarter results show continued traction on all fronts - revenue, bookings, customer acquisition, liquidity and technical advancements,” said Dr. Alan Baratz, CEO of D-Wave. “There is rapidly growing awareness of annealing quantum computing and its ability to deliver business benefits today, and the market is responding. This is further strengthened by our product development activities in hardware (Advantage2 prototype), software (new nonlinear hybrid solver and fast anneal feature), and quantum artificial intelligence. Our momentum as one of the few companies in the world leading the quantum transformation is evident.”

Bookings for the second quarter of fiscal 2024 were $2.7 million, an increase of $200,000, or 6 percent, from Q2 2023. This represents D-Wave’s ninth consecutive quarter of year-over-year growth in quarterly bookings.

During the quarter, the company said it worked with Turkey’s Ford Otosan to optimize vehicle production for the body shop, and with Hermes Germany on a vehicle routing quantum optimization application.

This month also saw D-Wave announce a quantum optimization pilot with Japanese telco NTT Docomo resulting in increased base station efficiency.