As we approach the end of the year, what is the state of the cloud and data center space in Southeast Asia? From the rapid growth of public cloud giants to a renewed focus on building new data centers, we look at the various news developments that occurred this year to take a stab at the likely trends and direction in the year ahead.

Cloud adoption driving the way

Attracted by the same benefits that have driven surging cloud deployments around the world, businesses in Southeast Asia are turning to the cloud. The public cloud giants are deploying more cloud regions than ever here, with various new cloud deployments and announcements made over the course of the year. Interest is expected to grow in the year ahead, as cloud players hold regional events to increase awareness and train new cloud experts.

Singapore has traditionally been the epicenter for public cloud players in Southeast Asia, and remains so with new cloud services or regions typically being established in the nation-state first. However, the largest cloud players have started deploying or announced plans to roll out new cloud regions in Southeast Asia, with Indonesia being one of the next top spots.

Specifically, Amazon Web Services (AWS) in April confirmed that it will launch a cloud region in Indonesia by the end of 2021 or early 2022, while Google Cloud Platform (GCP) is expected to launch its cloud in Jakarta next year. Not to be outdone, Alibaba Cloud launched its second data center in Indonesia early this year, barely 10 months after the launch of its first data center.

The growth of public cloud platforms in the region isn’t limited to Indonesia. Malaysia is expected to gain an Azure Cloud region next year, based on earlier DCD reports that Keppel subsidiaries are building a data center in Johor with Microsoft as the only tenant. Alibaba Cloud has also operated in Malaysia from Kuala Lumpur since 2017.

Rise of hybrid, multi-cloud enterprises

Despite years of rhetoric by the cloud giants, the growing consensus is that a cloud-only deployment isn’t suited for everyone. In its place is a rising interest in hybrid IT deployments, from enterprises saddled with existing legacy systems, or by tech firms such as Adobe and Tencent who require powerful private clouds for their internal use. Even the public cloud giants agree, and have launched on-premises solutions such as AWS Outposts and Google Kubernetes Engine On-Prem.

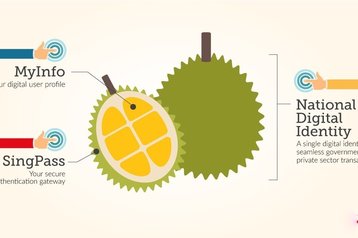

In addition, organizations are wary of being locked into a single platform or find that an alternate cloud service offer a capability that meet their needs better. The result is that modern enterprise cloud deployments are increasingly hybrid cloud affairs, and typically span over more than a cloud provider. This isn’t theory either - Singapore’s GovTech agency in October publicly shared that Singapore’s upcoming Singapore National Digital Identity (NDI) system is built to work across multiple clouds.

This trend towards hybrid and multi-cloud deployments is happening in the rest of the region, too, though is marred by inconsistent network performance. This explains why the likes of Colt are establishing and offering private connectivity to public cloud platforms. They are certainly not alone in offering network connectivity to connect the dots between the cloud and on-premises deployments; even the just-launched Iron Mountain Singapore data center touted its dark fiber connectivity to a top carrier hotel as an important benefit.

A renewed focus on data centers

Despite the current moratorium on new data centers in Singapore over concerns such as the outsized carbon footprint of data centers, the region as a whole looks set for higher data center growth. This can be traced back to a tightening focus on data locality, growing demand from cloud players, and a thriving digital economy.

In Malaysia, the new Pakatan Harapan government has launched various initiatives to address traditional weak areas such as connectivity. It introduced policies that led to a doubling of broadband speeds and lower prices, while the National Fiberisation and Connectivity Plan (NFCP) that seeks to further improve broadband and network communications infrastructure.

New data center development appears to be accelerating in Indonesia. We reported earlier this year that PT Telekomunikasi Indonesia (Telkom) is acquiring plots of land for new data centers and could be investing as much as a trillion rupiah (US$70M) in new data centers, even as hyperscale startup SpaceDC - backed by sovereign wealth fund GIC, is on track to deliver a 2.6MW facility next year and a 24MW one by mid-2021.

PT DCI in November announced its third data center in collaboration with Equinix with 12MW of capacity, while Princeton Digital Group, which acquired a majority stake in XL Axiata’s Indonesian data centers this year, will apparently be constructing a “large” hyperscale data center in the country.

Greener data centers

Yes, you have heard this before, but 2020 could well mark the start of a stronger, more concerted push to build greener data centers. While improving energy efficiency is daunting in the tropics, it makes perfect economic sense from a cost perspective. Expect efforts to eke out greater efficiency to continue, even as new data centers that are equipped with newer, more energy-efficient equipment help to bring the average PUE down.

Like it or not, most data centers in Southeast Asia draw from the national grid. This means that the average data center is less polluting in a place like Singapore, which uses natural gas to generate most of its power, compared to, say, Indonesia, which still relies heavily on coal-fired power plants. It does also mean that a genuine, long-term reduction of the region’s carbon footprint must involve renewables, coupled with the gradual decommissioning of more polluting energy sources.

On its part, the Singapore government has put together a masterplan to bolster the use of solar energy to reduce its carbon footprint. This won’t be enough, which is why the government is also funding research projects for novel strategies to cool data centers, as well as conducting research on tropical data centers. The latter is apparently completed, according to Wong Wai Meng, the CEO of Keppel Data Centres, though the findings yet to be announced.

Hopefully, the lessons learned can be applied across the region to benefit other Southeast Asia countries.