Google Cloud saw its revenue in Q2 2024 reach $10.35 billion.

Revenue increased more than $2 billion, or 29 percent year-on-year (YoY), and surpassed analyst predictions of $10.2bn.

It is also the first quarter where Google Cloud topped $1bn in operating income - with the division reporting $1.17bn, and an operating margin of 11 percent. This is up from $395m in Q2 2023.

During an earnings call, both CEO Sundar Pichai and CFO Ruth Porat noted that Google's artificial intelligence (AI) infrastructure and generative AI solutions for cloud customers have already generated "billions in revenues," and are being used by more than two million developers.

Porat noted that this quarter, as well as the one prior, has seen a reduction in headcount. This is expected to change in Q3 as the company brings in new graduates with a focus on "top engineering talent, particularly in cloud and technical infrastructure."

Q3 is also expected to have operating margins that reflect the impact of "increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure, as well as the increase in cost of revenues due to the pull forward of hardware launches into Q3."

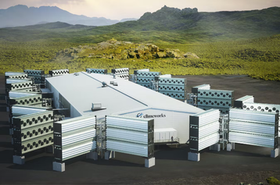

Capex for Q2 for Alphabet as a whole was $13 billion, though Porat notes the majority of this was driven by investment in technical infrastructure - largely servers, followed by data centers.

When asked if there is a risk of going from underbuilt to overbuilt in terms of investment in AI infrastructure, Pichai told analysts "the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over-investing, we clearly - these are infrastructure which are widely useful for us.

"They have long useful lives, and we can apply it across, and we can work through that. But I think not investing to be at the front here, I think, definitely has a much more significant downside."

Q2 saw Google release the sixth generation of its custom AI accelerator, Trillium, which Pichai said "achieves a near 5x increase in peak compute performance per chip and is 67 percent more energy efficient compared to TPU v5e." Pichai also noted that the Nvidia Blackwell GPU is set to come to Google Cloud in early 2025.

Google also partnered with Oracle during the quarter with the "Google Cloud Cross-Cloud Interconnect," which will enable customers to deploy general-purpose workloads across both Oracle and Google without transfer fees.

In September, the two companies plan to launch Oracle Database@Google Cloud, where Google will house Oracle Cloud Infrastructure's database services and high-speed network interconnect within its data centers.