Two of UK-based Kao Data’s investors have upped their stakes in the company.

Infrastructure investment firm Infratil as well as Legal & General Capital, the alternative asset platform of Legal & General Group, have increased their equity stakes in the data center operator.

Infratil will now hold a majority stake of 53 percent, Legal & General Capital will hold 32 percent; Goldacre Noé Group, Kao Data’s founding investors, will hold 15 percent.

Kao said the new shareholdings will provide “streamlined ownership and additional funding” for further growth and help accelerate its plans to scale across the UK.

“With our new capital structure and the ongoing support of our large, institutional investors, we believe Kao Data is perfectly placed to underpin the next wave of hyperscale and artificial intelligence innovation, during a time of exponential growth in digital infrastructure,” said Spencer Lamb, chief commercial officer, Kao Data.

Legal & General took a fifty percent stake in Kao in 2019, with Infratil taking a 40 percent stake in October 2021 (with L&G and Goldacre each holding 30 percent).

“Increasing our shareholding in Kao Data is in line with our strategy of investing in ’ideas that matter’ and continues our active support to scale the platform through contributing our extensive data center experience. With the expanding presence of artificial intelligence and its transformative impact on key technological and digital thematics at a global scale, increasing Infratil’s Kao Data stake demonstrates our confidence in the sector’s prospects.” said Vincent Gerritsen, head of UK & Europe for Morrison & Co, Infratil’s manager.

Matteo Colombo, managing director of Strategic Private Capital Investments at Legal & General Capital, added: “Society’s digital infrastructure needs will only continue to increase, and meeting these needs will unlock productivity, innovation, and economic growth locally and internationally. Legal & General are enthusiastic to support this as an active shareholder of Kao Data on its continuing exciting growth journey, having successfully grown from a single site since investment to now four sites.”

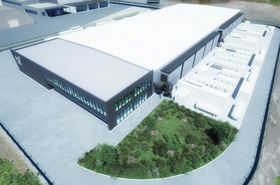

Kao was launched in 2015, and its Harlow campus outside London opened in 2018; the facility promises to have around 150,000 sq ft (14,000 sqm) of white space, and a total of 35MW of power across four phases. A second building at the campus – which houses Nvidia’s Cambridge-1 supercomputer – was announced last year. The company has opened a second facility at Kao Park, and a data center in Slough. It also operates a former Barclays data center in Northolt.

The company recently announced plans for a 40MW data center in Manchester. The first phase of the 419,800 sq ft (39,000 sqm) site is due to go live in 2025.

“This moment marks an important next step in the Kao Data journey. With Infratil and L&G raising their stakes in the business, we are well-positioned for the growth opportunities presented by the data center market, including the exploration of opportunities across Europe,” said David Bloom, partner, Goldacre Noé Group and chairman, Kao Data.

“The founder investors had a clear vision for this business, and their continued presence as shareholders gives confidence about our ability to realize the potential of Kao Data."

More in UK & Ireland

-

-

-

Discussion Networking break