Investment firm Infratil is raising money to grow its data center company, CDC.

The company this week announced an approximately NZ$1.150 billion ($702.8m) equity raise to fund further investments into the data center operator CDC’s growth.

The raising comprises an underwritten NZ$1 billion (US$610m) placement of new IFT shares and a NZ$150 million (US$92m) non-underwritten retail offer of new IFT shares, with the ability to accept over-subscriptions.

Infratil expects to commit equity funding of around AU$600 million (US$395.3m) to CDC over the next two years to execute its medium-term development pipeline. The company will also be investing in its renewables, digital, and healthcare platforms

Infratil CEO Jason Boyes said: “CDC continues to see a surge in demand for data center capacity. The proceeds of the equity raising will be used to fund its accelerated growth, and provide additional balance sheet flexibility to allow Infratil to continue to invest across our portfolio.”

He continued: “Demand continues to accelerate on the back of cloud adoption and significant investments in Generative AI. This rapid increase in demand has seen CDC enter advanced negotiations with customers for over 400MW of capacity at multiple sites across the CDC footprint, with this capacity expected to come online over the next four to five years.”

Founded in 2007, Canberra Data Centres (CDC) has 14 Australian sites in operation and seven in development across Sydney, Canberra, Melbourne, and Auckland, New Zealand. Infratil first invested in CDC in 2016.

The company recently filed for a 500+MW campus in the Marsden Park area of Sydney. Infratil said CDC expects 200MW+ of capacity to commence construction over the next 12 months, including the first tranche of Marsden Park.

CDC CEO Greg Boorer said: “We are seeing an unprecedented increase in the number of customer discussions, many of which are tied to AI-related workloads. CDC has been AI-ready for more than 15 years, and is well-positioned to capture a strong share of AI-driven demand.

“Including reservations and rights-of-first refusals, over the last 18 months we have signed contracts for 200MW+ of capacity and we continue to see higher demand in the Australian and New Zealand markets. Our recently announced Marsden Park campus is in direct response to these demand signals and is a strong indicator of the step change in the scale of demand and development we expect to execute on in the period ahead.”

Barrenjoey Markets Pty Limited, Goldman Sachs Australia Pty Ltd, and UBS New Zealand Limited are acting as Joint Lead Managers.

In an Infratil investor presentation, the company said CDC was in advanced negotiations with customers for over 400MW of capacity across multiple sites, which is “expected to accelerate” CDC's capital expenditure and funding needs.

CDC’s current development pipeline has a total planned capacity of ~1,870MW, significantly more than its current 300MW operating capacity. The AU$600m Infratil aims to invest in CDC will provide sufficient capacity to execute on its medium-term pipeline.

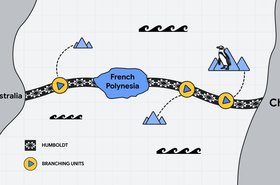

Infratil is also an investor in UK operator Kao Data, New Zealand tower firm Fortysouth, Kiwi telco One.NZ, and ConsoleConnect.