British chip designer Graphcore has been acquired by Japan's SoftBank Group Corp.

Graphcore will become a wholly-owned subsidiary of SoftBank, but will continue to operate under the Graphcore name. The value of the deal has not been shared.

Graphcore's headquarters will remain situated in Bristol in the UK, with offices in Cambridge and London, as well as Gdansk in Poland and Hsinchu in Taiwan.

“This is a tremendous endorsement of our team and their ability to build truly transformative AI technologies at scale, as well as a great outcome for our company,” said Graphcore co-founder and CEO Nigel Toon. “Demand for AI compute is vast and continues to grow. There remains much to do to improve efficiency, resilience, and computational power to unlock the full potential of AI. In SoftBank, we have a partner that can enable the Graphcore team to redefine the landscape for AI technology.”

“Society is embracing the opportunities offered by foundation models, generative AI applications and new approaches to scientific discovery,” said Vikas J. Parekh, managing partner at SoftBank Investment Advisers. “Next-generation semiconductors and compute systems are essential in the AGI journey, we’re pleased to collaborate with Graphcore in this mission.”

Graphcore has been looking for a buyer since February 2024, looking for a sale that could value the business at over £400 million ($504m). In May, it was reported that SoftBank was looking at acquiring the chipmaker.

Peter Kyle, the secretary of state for science, innovation and technology, has backed the deal, saying it was a “welcome end to the uncertainty that has faced Graphcore and its employees.”

SoftBank already owns a majority stake in Arm, having bought the British chip designer for $32 billion in 2016 and retained a controlling interest in the company when it re-floated on the stock market last year.

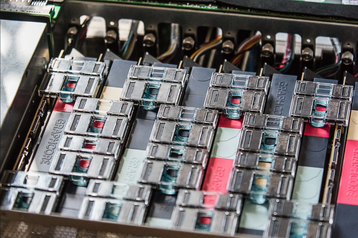

Founded in 2016, Graphcore makes AI accelerators called Intelligent Processing Units, or IPUs, which have been marketed as an alternative to GPUs produced by Nvidia.

The company has been struggling with serious financial difficulties. In October 2023, Graphcore’s 2022 financial statements revealed the company had made pre-tax losses of £161 million ($204m), with revenue dropping 46 percent to £2.1m ($2.7m), approximately one percent of the losses it posted.

At its peak, it had an estimated value of £2.1bn ($2.8bn). If this acquisition valued Graphcore at the previously estimated £400m, that would mean the company is worth less than 25 percent what it was previously.

The Financial Times, citing people familiar with the matter, reports that the deal was actually valued at $600m, still a significant blow to the company's previous valuation.

In 2023, the company was forced to pull out of China, a market previously targeted as a major growth area for the company, due to US export controls.

Then in March 2024, Graphcore was accused of unfair play by cloud company HyperAI.

HyperAI said that the company had reneged on a partnership by claiming exclusivity with another European cloud provider; telling HyperAI it couldn’t provide it with previously offered technical support due to Graphcore firing a lot of its engineers; and ultimately trying to claim that it never sold HyperAI one of its products, despite the company having already received it.