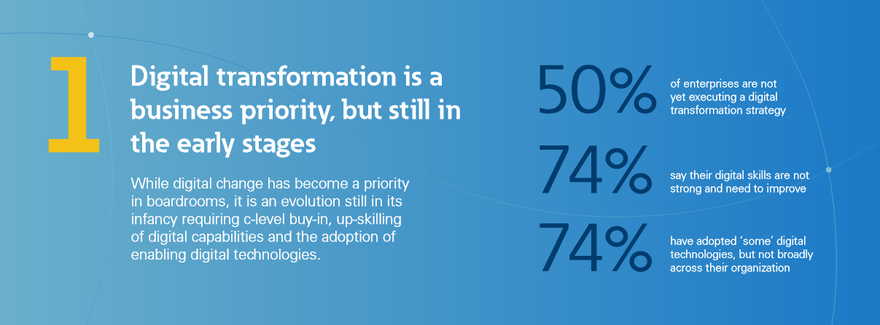

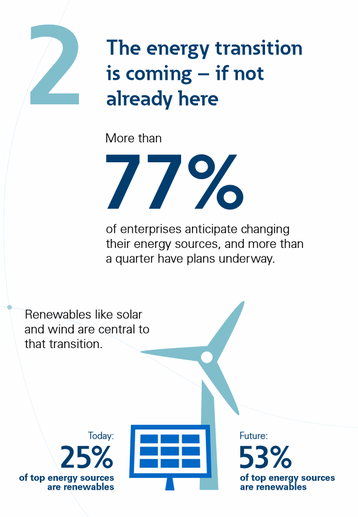

New research indicates that while three-quarters of companies expect to shift away from their current power sources, just half are pursuing the digital strategies required to support such a migration.

That is just one of the findings in the S&P Global Market Intelligence report – The Intersection of Digital Transformation and the Energy Transition, commissioned by Eaton.

“We identified a major gap in how businesses are applying digitalization to realize decarbonization goals and this research is a wake-up call, shedding light on the opportunities for businesses to focus investments and make a bigger impact,” said Aravind Yarlagadda, executive vice president and chief digital officer at Eaton.

“Businesses need to move far faster on digital transformation. The good news is that the time for action is now, and tools like our Brightlayer digital foundation help businesses gain deeper energy insights that are essential to evaluate worthwhile investments. Our industry-specific software suites are already helping customers meet these challenges.”

The study encompassed 1,001 respondents involved in digital transformation efforts across four power-critical business sectors in North America, Europe, the Middle East and Africa, including: buildings, data centers, industrials and utilities.

“Until now, enterprise transformation projects have focused primarily on optimizing business processes. The coming energy transition will impact digital best practices and processes and will prove an important competitive differentiator for firms that are first to embrace that approach,” according to Rich Karpinski, senior analyst, 451 Research, part of S&P Global Market Intelligence.

Sector research findings

Building owners and operators made clear power optimization and ESG reporting are critical issues. Sustainability is the top goal for this sector, prioritized by 46 percent of the sector respondent. Yet, building owners are skeptical that smart building initiatives will pay off: the top digital challenges include calculating a favorable cost/benefit analysis (cited by 52 percent building survey respondents) and a lack of pressing digital use cases (45 percent).

Data centers have embraced digitalization and are now looking for next-generation digital opportunities to either streamline operations or generate revenue to create competitive advantages. Next-step goals involve increasing use of renewables, cited by 50 percent of data center owners; improving energy storage, according to 47 percent of respondents; and making money selling power back to the grid, chosen by 34 percent.

Industrials have focused digitalization efforts on perennial challenges like addressing skilled worker shortages. Yet, digitalization addressing energy transition lags. Only 24 percent of industrials cited energy and power concerns as a key digital driver for industrial transformation. For industrials to maintain or gain a competitive upper hand, applying digitalization to the energy transition will be a key advantage.

Utilities are facing massive shifts in energy generation as renewables increase along with the need for increased digital intelligence. Digital transformation is essential to new business models and revenue sources, including support for electric vehicles (EV) through customer EV-charging needs (identified by 49 percent of utility respondents) or EV charging stations themselves (cited by 45 percent).

Read the full report, The Intersection of Digital Transformation and the Energy Transition and learn more about how Eaton is helping to accelerate digital transformation and the world's energy transition.

More...

-

Case study: Basefarm provides pivotal role in frequency response market

A case study looking into how Basefarm mitigated the environmental impact of its data center

-

Sponsored How data centers will support renewable power adoption

Pledging support for renewable power is one thing, but properly making the shift is quite another, says Eaton’s Janne Paananen and Ehsan Nasr

-

Microsoft teams up with Eaton for 'grid-interactive' UPS at Dublin data center

As Ireland grows increasingly hostile to data centers due to grid concerns