Indian telco Vodafone Idea (Vi) is reportedly seeking a loan of $2.75 billion to fund the expansion of its 4G network and deployment of its 5G network.

As reported by Economic Times, India's third biggest carrier has proposed borrowing INR 230 billion ($2.75bn) from banks in the country.

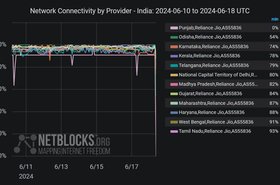

The telco, which has had its well-documented financial struggles, has fallen behind Reliance Jio and Bharti Airtel in the country's 5G race.

But in January, Vi's CEO Akshaya Moondra said that its 5G launch is about "six to seven months away."

ET reports that Vi submitted a proposal to a State Bank of India (SBI)-led banking consortium a few days ago.

The publication said the funds will support upgrades to Vi's mobile broadband network infrastructure.

"Vi has now formally approached banks. The presentation was essentially giving details of what it plans to do in the future, such as infrastructure upgrades,” said a source to ET. “Banks have taken note of it and now moved to a TEV (techno-economic viability), which will take a couple of months."

Vi recently held a $2.16 billion follow-on Public Offering (FPO) in India through a sale of new shares. It said at the time that the funds would be used to expand its 4G network and launch its 5G network.

The company, which was created in 2018 following the merger of Vodafone India and Idea Cellular, has been struggling to pay its dues with its vendor partners after it was saved from the brink of collapse by the Indian government in 2022, which acquired a 35.8 percent stake in the company.

The financial issues have meant that Vi has fallen behind on payments to its tower and equipment vendors, owing 135 billion rupees ($1.6bn).

The company has come under fire from Bharti Airtel chairman Sunil Mittal, who has warned the carrier to pay its dues to Indus Towers, part-owned by Airtel, which currently stands at $1.2 billion, or lose access to its towers.

Last week, Vi said it would issue shares worth 24.58 billion rupees ($294.3 million) to network vendors Ericsson and Nokia to clear its dues.

This means that Nokia will have a 1.5 percent stake in Vi, while Ericsson will own 0.9 percent of the telco.