In the age of digital transformation, data centers have become the nerve centers of global economies.

Singapore, a global hub for finance and technology, has experienced its share of challenges in dealing with its data center demand, as it became the world’s second largest data center market, second only to the behemoth which is North Virginia and easily the most important interconnection point in APAC.

However, as an Island State of just 734 square kilometres, it is very short of the resources that scalable data centers typically require, in particular availability of land and renewable energy.

With an abundance of key strategic benefits and with strong existing relationship with Singapore, Perth in Western Australia (WA) emerges as its most strategic data sharing partner.

One of the key foundations of this relationship lay in The Singapore-Australia Digital Economy Agreement (SADEA), although the reasons extend far beyond. Let’s explore the multifaceted reasons why Perth is poised to be the natural overflow and redundancy solution for Singapore's ongoing data center needs.

1) The SADEA: Is Singapore's second Digital Economy Agreement (DEA) and creates opportunities for enhanced collaboration and data sharing, especially, although by no means exclusively in the financial and AI sectors. The SADEA encompasses eight key Memoranda of Understanding (MOUs) that include:

- Artificial Intelligence (AI)

- Data innovation

- Digital identities

- Personal information protection

- Electronic invoicing (e-invoicing)

- Trade facilitation

- Electronic certification on agricultural commodities

- Consumer protection.

2) Perth (WA) has some of the lowest per MW power on Earth: A primary reason for this is back in 2005, the then WA Carpenter Labor Government demanded the big WA gas producers such as Chevron and Woodside reserve 15 percent of their WA production for the local market.

This means WA never has to compete with the international market, ensuring supply whilst shielding it from global volatility and price fluctuations. These energy cost savings are not small either.

Leading independent energy advisory company Presync recently benchmarked the top 10 global data centre markets and found that Perth’s per MW energy pricing to be 372 percent cheaper than the mean average (as at 1 March 2023).

With data center costs linked to AI Demands rising, securing the cheapest and greenest power possible will be paramount and there are arguably very few places on earth as well suited to this as Perth.

3) Sub-sea cables: Perth’s proximity to the Asia-Pacific region and direct connectivity through four international subsea cables offers low latency connectivity to Singapore, Jakarta, the Middle East and Europe, include:

- Australia-Singapore Cable (ACS) - High-capacity and low-latency submarine fiber optic cable system between Perth and Singapore. Operated by Vocus, the ASC can provide unprotected or protected options in speeds with speeds up to 100Gbps.

- INDIGO Central - Provides low latency, high-capacity services between Perth & Sydney. Completed in 2019 by SUBCO, the cable is amongst the lowest latency routes between the East and West coast of Australia.

- INDIGO West - Provides low latency, high-capacity services between Singapore and Perth with two fibre pairs also connecting Singapore to Jakarta. Completed in 2019 by SUBCO, it provides the lowest latency capacity systems between Asia and Australia.

- Oman Australia Cable - This new express undersea cable directly connects to Muscat, Oman and Perth, and is owned and operated SUBCO. The cable went live in Sept 2022, and offers the lowest latency path between Australia and Europe, Middle East and Africa (EMEA).

- SEA-ME-WE 3 (South-East Asia, Middle East, Western Europe 3) - A submarine cable linking 39 cable landing stations in 33 countries and four continents, including Asia, Perth (Australia), Africa and Europe.

Additional future fibre infrastructure includes Bevan Slattery's SUBCO planed 300Tbps Sydney-to-Perth subsea cable which is set to deliver over 300Tbps per section at 15Tb/kW between Sydney and Perth.

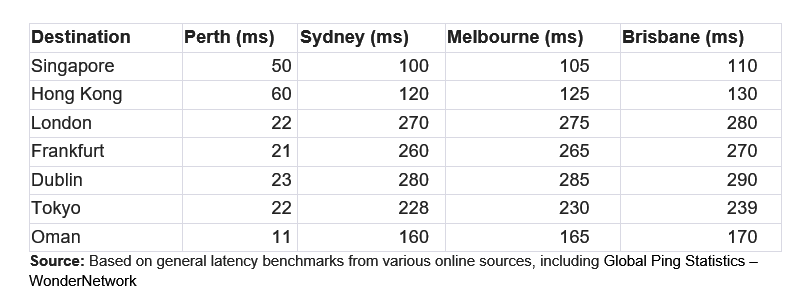

4) Low latency: The average latency between Singapore and Perth is 50ms, half of that between Sydney and Singapore. The following table shows Perth's latency speeds compared to other Australian cities:

5) Renewable energy: Western Australia boasts abundant solar energy resources, with WA constantly being ranked in the top 10 list for wind and solar resources.

GreenSquareDC's recent announcement to develop its own wind & solar park to support its flagship WAi1 Perth Data Center highlights the future need to integrate direct renewable energy sources to help reduce customers ESG and Sustainability concerns.

We’ve already seen large data center projects being stalled and cancelled, even though they were to use renewable energy. In years to come, we’re going to see all power be at a premium, including renewable power.

The view of the voting Public moving forward will be that renewable power should be used for schools, hospitals and homes, and not just for data centers. Wait and watch this thematic play out unprepared at your own peril.

6) Alternative energy sources: WA has substantial offshore wind energy and tidal energy opportunities, due to its extensive coastline, robust wind resources, and existing energy infrastructure.

Perth is also well advanced in the future supply of Green Hydrogen, including Woodsides H2Perth Project and BP’s H2Kwinana Green Hydrogen Hub. WA's geothermal and aquifer energy resources offer another highly renewable energy option.

By way of example, CSIRO has successfully cooled the Pawsey Supercomputing Centre in Perth for over 10 years via a groundwater cooling system. This removes heat from the supercomputers and reinjects and dissipates this heat into the Grand Canyon sized aquifer below the centrer.

This has proven to have no net loss of groundwater or impact on the aquifer, whilst also removing the need for cooling towers. GreenSquareDC is working to implement a similar system at its flagship WAi1 project in Perth.

7) Land availability: As the largest State in Australia covering 2.5 million square kilometres (approx. 10 times the size of the UK, seven times the size of Japan and four times the size of Texas), WA has large expanses of land, low population density and dry, stable environmental conditions for data center operations.

8) Rental relief and improved vacancy rates: Singapore is the world’s most power-constrained data center market, with less than 4MW of available capacity and a record low data center vacancy rate of well below two percent.

Singapore also has the highest rental rates in the world at $300 to $450 per month for a 250kw to 500kw requirement. Perth offers rental rates of around half this, with significant capacity coming online.

All cost savings in rental rates can be redirected towards other operational areas, ensuring better service delivery and improved profit margins for customers choosing Perth.

9) Reduced risk of natural disasters: Unlike much of the rest of the APAC region, Perth is known for its extremely low occurrence of natural disasters. The city is not prone to earthquakes, tsunamis, or tropical storms, reducing the risk of catastrophic events that could impact data center operations.

In fact, Perth has never experienced a major natural disaster that has, or would likely significantly impact its data center network operations.

10) Political stability: Western Australia, has a strong reputation for political stability and a robust legal framework. This stability creates a favorable business environment and reduces the risk of unexpected disruptions or policy changes that could impact data center operations.

11) Economic stability: WA has maintained a stable AAA credit rating for the past decade and is the only State or Territory in the Australia to have the top credit rating from both major international rating agencies, and one of a very small number of jurisdictions globally with such a rating.

12) Geographic isolation: Perth, is one of the most isolated capital cities on earth and is therefore geographically isolated from other major urban centres and data center hubs in both Australia and the Asia-Pacific region. This isolation reduces the risk of simultaneous disruptions affecting multiple locations and can enhance interconnected network resiliency.

13) World class builders: WA benefits from being home to some of the world’s best builders, including the Brookfield owned Multiplex which GreenSquareDC recently partnered with to create APAC's first fully AI enabled data center.

Being home to one of the largest resource industries on the planet also helps ensure availability and serviceability of a lot of the large plant and equipment required for hyperscale data centers.

14) Skilled workforce: The region's focus on AI and related fields creates a talent pool that is well-equipped to support AI data center operations.

For instance, the University of Western Australia offers an advance degree in Artificial Intelligence, and four of Perth’s five universities offer comprehensive cyber security courses, building a future workforce of digital, AI and cyber capable graduates.

15) Supportive government: The WA Government released its independent Data Centre Prospectus in Nov 2022, highlighting the State’s willingness to create a global hub for data center operations.

The WA Government is in the process of transitioning to being a ‘Resources, renewables and digital state’, not purely a ‘resources’ one and recognizes that developing the industry will help further diversify the economy and create high skilled jobs, especially in the field of Artificial Intelligence (AI).

16) Innovative data centerss: Innovation leaders like GreenSquareDC and its flagship 96MW WAi1 data center in Perth, focuses on providing highly efficient, flexible and sustainable GPU based workloads.

The presence of GreenSquareDC with these attributes in WA can help Singapore and other APAC countries to leverage quicker deployment of scalable AI and GPU based workloads and achieve significant cost savings, improve environmental sustainability, and accommodate the power demands of AI driven workloads.

Perth, Western Australia has the potential to service Singapore overflow and redundancy needs and also capture a significant market share of the APAC GPU based AI data center industry.

The region's unique advantages, including its geographic location, super low per MW power pricing, renewable energy, skilled workforce, and innovative data centers position it as a highly favorable destination for global AI digital infrastructure investment.

GreenSquareDC’s white paper, ‘Elevating Perth: The future global epicentre for AI digital infrastructure’ further emphasising Perth’s strategic advantages as a prime location for GPU based AI digital infrastructure.

More from GreenSquareDC

-

Sponsored Is it time to replace diesel backup generators?

The path towards greener data center backup

-

Sponsored GreenSquareDC: The future of AI-ready, ethical and sustainable data centers

Introducing the AI-ready data center helping customers achieve their decarbonization and wider ESG goals

-

Sponsored GreenSquareDC and Multiplex partner on Australia’s first fully AI enabled data center

Multiplex enters agreement as preferred contractor for GreensquareDC's revolutionary $1bn 96MW WAi1 net-zero data center project in Perth